Shockflation Has Uprooted the European Union: High Time for New Policy Tools

Télécharger le pdf

14/06/2024

14/06/2024

Voir tous les articles

Voir tous les articles

Shockflation Has Uprooted the European Union: High Time for New Policy Tools

Anger over the cost of living has contributed to the rise of the far right across Europe. Although prices are stabilizing, many countries have experienced a dramatic decline in real wages. Today, the answer to inflation is for the European Central Bank (ECB) to raise interest rates. This serves to fight wage increases and avoid a wage-price spiral. But faced with inflation unleashed by supply shocks and propagated by firms’ pricing decisions, this approach causes economic insecurity for too many and deepens the cracks in already fragile democracies.

Going forward, the European Union (EU) will remain vulnerable to inflation and economic shocks. It navigates an age of overlapping emergencies: pandemics, geopolitics and environmental breakdown. To deal with these ongoing crises, the EU will also need to mobilise unprecedented levels of private and public investment. These conditions put conflicting demands on inflation governance. Investment requires low interest rates, but the ECB’s response to inflation is today to raise monetary policy rates.

In a new report 1 , we argue that the EU needs to change its approach to inflation to deal with these conflicting demands. We need pragmatic, targeted policies across the EU’s economic policies. Mario Draghi pointed out in his recent speech: “our organisation, decision-making and financing are designed for ‘the world of yesterday’ – pre-Covid, pre-Ukraine, pre-conflagration in the Middle East, pre return of great power rivalry.” 2 This also applies to the EU’s inflation governance framework. It has been designed to fight a certain idea of yesterday’s inflation and leaves us unprotected against the inflation ahead of us.

During the decades preceding 2022, EU inflation stayed low in part due to cheap production in East Asia and new supply chains that included China. Between the start of the ECB’s operations in 1998 and the 2020 COVID-19 pandemic, the price of consumer goods went up only 0.6% per year; even as the quality and quantity of available products expanded dramatically. But wages in China will keep going up and supply chains will face new geostrategic risks. Meanwhile, an unfolding climate and environmental crisis confronts the EU with extreme weather events and natural disasters as well as a costly transition away from fossil fuels. There are also risks at home. Having learnt new lessons during the recent inflationary episode, firms are already developing new strategies to benefit from cost shocks. Over time, firms get better at raising prices and passing on cost increases to consumers, increasingly using algorithmic approaches.

In short, many risks conspire to again bring about severe inflationary shocks such as the EU experienced at the end of 2021 and the start of 2022. We call inflation unleashed by sector-specific shocks “shockflation”. Such shocks are particularly nefarious when they raise systemically important prices such as those of energy and food. These essential prices touch every part of the economy. In this regard, energy and food are different from, for example, haircuts and other retail services, which have relatively stable prices and limited impact on economy-wide inflation. Energy and food are not only an important part of people’s consumption basket, they are also important inputs to other sectors. They are systematically significant prices 3 , just like the cost of housing, finance and infrastructure. Once these prices go up, firms downstream often do not absorb the corresponding cost increases. Rather they propagate the price shock by raising their prices, increasing profits and creating “sellers’ inflation” 4 . This is how the 2022 energy price shock caused inflation rates of over 20% in some Member States.

From its founding in 1993 onwards, the EU has come to rely ever more on the monetary policy of the European Central Bank to deal with inflation. Policymakers remain haunted by a fear of a wage-price spiral: high wages can bring firms to raise prices, in turn leading workers to demand higher wages, so the fear goes. But this focus on wages is unduly short-sighted. Shocks to systematically significant prices do damage to the economy long before they cause a wage-price spiral. Higher prices strike at the cost of living of the poorest households. Indeed, rising wages in response to such shocks are an important way to offset their effect on the cost of living. In 2022, inflation went into higher profits, not wages: the corporate sector effectively protected its profit margins against the cost shock, with unit profits going up.

A monetary policy response to shockflation also has negative side effects. Higher interest rates make investments more expensive. Using monetary policy to deal with shocks harms exactly those investments most needed to protect the European economy against future shocks. Higher rates also constrain the fiscal space of the EU and its Member States, hindering governments from responding in an agile way to new crises.

In short, when shocks ripple through the economy, the EU’s current governance does not work. It vacillates between two untenable options: doing nothing or taking drastic, economy-wide monetary policy measures. The first option of waiting for inflation to go down does little if anything to address the negative economic and social effects of inflation. The second option of raising monetary policy rates is costly and does not address many of the negative effects of inflation. Across the continent, investments in renewable energy are cancelled 5 because ECB interest rates are at record heights.

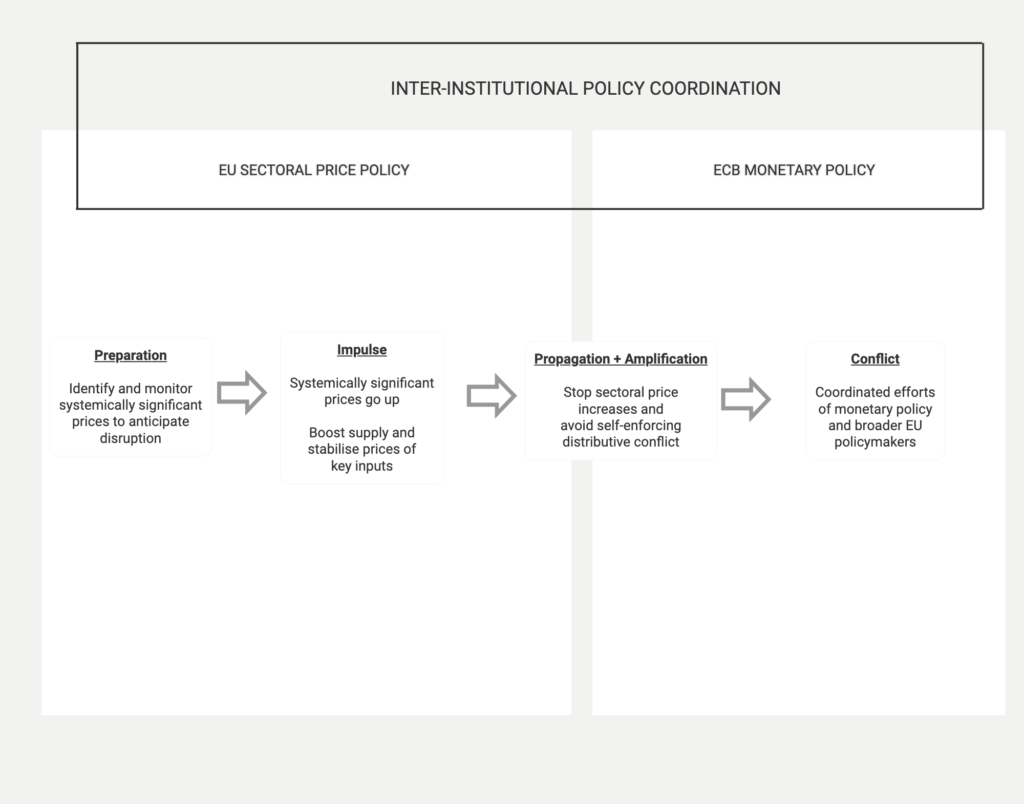

In our new report “Closing the EU’s inflation governance gap”, we set out key elements of a new governance framework. We need institutions to monitor adequate supply, an early warning system for price spikes, to pre-empt shocks and address the impact of systemically significant prices before price explosions ripple through the whole economy. The EU already has sectoral policies that can be mobilised to address sectoral price increases before they are turned into generalized sellers’ inflation. These include sector-specific supply-side policies such as the 2023 European Chips Act 6 , which sets up a new framework to stabilise the price of semi-conductors. A whole arsenal of unconventional policies were also mobilized to fight the 2022 energy shock. However, the EU currently lacks a coherent governance structure and, hence, so far measures have been slow and uncoordinated.

The EU treaties provide ample scope to address inflation through coordinated action involving the European Central Bank and the political bodies of the EU as well as specialised actors such as statistics offices and market regulator. It is a myth that fighting inflation is only the task of the ECB. In fact, one of the overarching objectives of the EU as a whole is “the sustainable development of Europe based on balanced economic growth and price stability” 7 .

Going forward, coordination between the European Central Bank and the EU’s legislative bodies should serve to align inflation governance across the different sectors of the European economy. For essential sectors such as energy, food and critical raw materials, the EU and its Member States should build capacity to balance supply with physical buffer stocks, stabilising prices with virtual buffer stocks and capping prices when corrections of supply shortfalls. In this spirit, Draghi has rightly called for 8 the creation of a EU Critical Mineral Platform for “joint procurement, [to] secure diversified supply, the pooling and financing, and stockpiling.” European storage facilities with equitable access across EU Member States can leverage the size of the combined European countries in stabilising market participation.

A further set of tools should deal with firms that use cost shocks as an opportunity to boost their profits. As ECB president Christine Lagarde has rightly pointed out, the EU needs better data on profits. In addition, this data could be monitored continuously in a similar way as systemically significant prices. An effective way to prevent price gouging is a credible windfall profit tax framework. The European Treaties have since 1957 prohibited firms 9 from using a dominant position in a market to “directly or indirectly imposing unfair purchase or selling prices”. However, the EU’s competition authorities have to date largely ignored this crucial provision. The European Commission should develop a framework for enforcing that provision today.

After the global financial crisis, new stress tests were introduced for the banking sector and banks that are too-connected or too-big-to-fail were singled out for regulatory oversight. The ongoing inflation crisis requires a rethink of inflation governance in a similar way: prices in sectors that are too-essential-to-fail need to be stress tested, monitored and regulated. They need to be buffered against shocks since they present points of vulnerabilities for our economies, societies and democracies. The EU needs an inflation governance framework that prevents the worst of times for many ending up as the best of times for powerful corporations.

Shockflation has uprooted the EU. Will it finally get the policy tools it needs?

Notes

- Jens van’t Klooster and Isabella Weber, «Closing the EU’s inflation governance gap», EGOV, European Parliament, 14 June 2024.

- Mario Draghi, «Radical Change—Is What Is Needed», Groupe d’études géopolitiques.

- Isabella M Weber, Jesus Lara Jauregui, Lucas Teixeira and Luiza Nassif Pires, «Inflation in times of overlapping emergencies: Systemically significant prices from an input–output perspective», Industrial and Corporate Change, Oxford Academic, February 6th, 2024.

- Isabella M. Weber and Evan Wasner, Sellers’ inflation, profits and conflict: why can large firms hike prices in an emergency?, Review of Keynesian Economics, vol. 11 n°2, April 14th, 2023.

- Richard Millard and Mari Novik, «European utilities cut renewable targets as high costs and low power prices bite», Financial Times, 19 mai 2024.

- European Chips Act.

- Treaty on European Union – Title 1: Common provisions – Article 3.

- Mario Draghi, «Radical Change—Is What Is Needed», Groupe d’études géopolitiques, April 16th, 2024.

- Treaty of the Functioning of the European Union, Part 3, Title VII, Chapter 1, Section 1, Article 102.

citer l'article

Jens Van’t Klooster, Isabella Weber, Shockflation Has Uprooted the European Union: High Time for New Policy Tools, Jun 2024,