The Ukraine war and the energy transition

Jorge E. Viñuales

Professor of Law and Environmental Policy at the University of CambridgeIssue

Issue #5Auteurs

Jorge E. Viñuales

Legal Journal published by the Groupe d’études géopolitiques in partnership with Le Club des juristes

The global energy crisis resulting from Russia’s invasion of Ukraine is deceptively familiar. Since the 1970s, the weaponization of energy exports has become a real possibility, used to great effect in a handful of cases. It first emerged when, in 1973, certain members of the increasingly assertive Organization of Petroleum Exporting Countries (‘OPEC’), which had organised themselves as the OAPEC (‘A’ standing for Arab), imposed an embargo on oil exports against supporters of Israel in the Yom Kippur war. The spike in the price of oil that followed bears a clear resemblance to that of fossil fuels, particularly gas, observed in the last year, and it has been largely driven by the decision of a major producer, Russia, to achieve a political aim in the context of a military confrontation.

Yet, the analogy is deceptive. It fails to capture a fundamental difference, namely that Russia’s offensive takes place at a crucial moment within a broader process of energy transition and socio-economic transformation driven by the need to reduce emissions of greenhouse gases. In its recent 2022 World Energy Outlook, the International Energy Agency (‘IEA’), itself a child of the 1973 energy crisis, has lucidly noted this major difference. 1 It means that, unlike the response to the 1973 crisis, which did not question the place of oil in the energy matrix, today’s response involves a much more fundamental transformation of the energy system away from reliance on fossil fuels, which is already underway as a response to the much wider phenomenon of climate change. From this perspective, today’s energy crisis must be seen as a clash in an ongoing tension driven by climate change between two competing socio-technical regimes, one based on fossil fuel technologies and another on low-carbon ones.

Months before Russia launched its offensive, the very ‘rescue’ and ‘recovery’ policies introduced by governments to navigate the COVID-19 pandemic had raised red flags due to their general inconsistency with climate action. 2 As the pandemic or, more specifically, the lockdowns imposed as a result of the pandemic receded, the fear of having back-tracked on the effort to decarbonise energy systems became increasingly visible. But back-tracking fears reached new heights following the Russian offensive, which deliberately relied on energy exports manipulation to pressurise European countries not to interfere with Russian aims. In Europe, high energy prices and their associated political costs provided a new rationale for the temptation to revert to fossil fuels, pitting short-term political needs against medium- and long-term energy transition strategies.

In this context, today’s energy crisis has deeper roots than the Russian invasion of Ukraine. The fundamental question, from an energy perspective, is whether the current crisis threatens the viability of the ongoing energy transition or not and, more realistically, whether it does so to some degree in at least some parts of the world. There is no single answer to this question, but in searching for possible answers, there are three long-held assumptions of energy policy that should no longer be assumed, namely: that fossil fuels are the key to cheap energy, that States face an ‘energy trilemma’ opposing energy security, affordability and sustainability, and that climate policy is costly and incites a ‘race-to-the-bottom’, ie the dismantling of environmental policy to increase competitiveness. In this brief contribution, I revisit these assumptions. My overall point is not that one or more of them may not be relevant for a specific country, at a specific point in time, but that they no longer can be held as ‘assumptions’ or basic tenets of energy policy.

1- Cheap energy from fossil fuels?

Energy prices are a complex concept. First, there are important differences between different energy commodities (ie the resources used to produce a certain energy product), such as coal, crude oil, natural gas or uranium, but not sunlight or wind, which are not priced commodities. Secondly, depending on the commodity, there may also be significant regional differences in prices, such as for natural gas. Thirdly, from the perspective of products, particularly electricity, assessing the price of electricity produced from different technologies and, specifically, from power generation facilities at different stages of their operation, requires non-trivial adjustments, embodied in the concept of levelised cost of electricity. Fourthly, the data and measurement from different reports may vary, sometimes significantly, depending on what aspects are emphasised and which ones are played down or excluded. These and several other differences stem from the basic observation that the term ‘energy’ is a conceptual construct aggregating very different realities. One can observe the evolution of different measurements of this aggregate (eg an energy commodity price index 3 ) but, for the analysis of the prospects of the energy transition, the assessment must necessarily be more granular.

In the latest World Bank report on Commodity Markets Outlook, of October 2022, it is observed that overall:

‘[m]ost commodity prices have retreated from their peaks in the aftermath of the post-pandemic demand surge and war in Ukraine as global growth slows and worries about a global recession intensify. However, individual commodities have seen divergent trends amid differences in supply conditions and their response to softening demand.’ 4

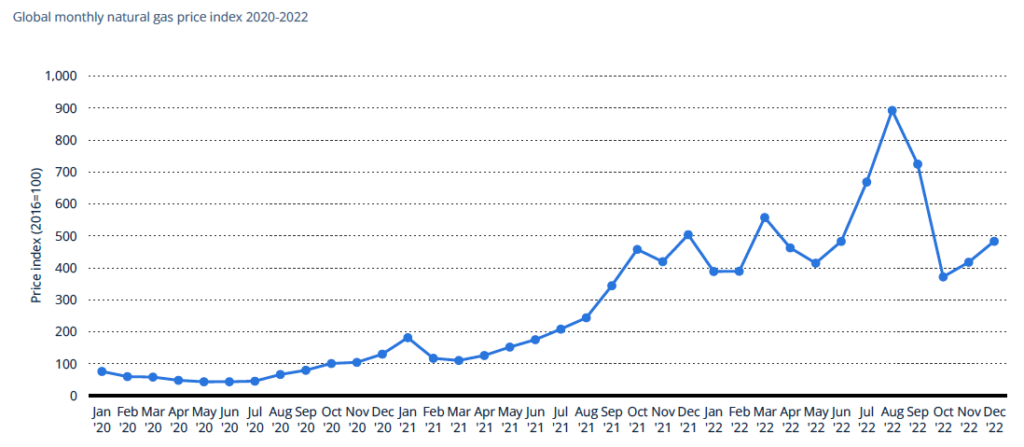

The focus of this observation is on the pandemic, the war in Ukraine and the economic slowdown, rather than on the longer-term energy transition. Importantly, the price of fossil fuel resources (coal, oil and natural gas) saw a sharp increase starting in late 2021, with the post-pandemic rebound, reaching all-time highs (for natural gas) due to the weaponization of such resources by Russia as part of its strategy in the Ukraine war, and then declining as a result of successful reserve replenishment efforts in Europe, milder than expected weather, the economic slow-down, the tightening of credit (to fight inflationary pressures) and fears of an economic recession. According to the IEA’s World Energy Outlook 2022, the Ukraine crisis provided

‘a short-term boost to demand for oil and coal as consumers scramble for alternatives to high priced gas. But the lasting gains from the crisis accrue to low-emissions sources, mainly renewables, but also nuclear in some cases, alongside faster progress with efficiency and electrification’. 5

Although all three main fossil fuel resources, coal, oil and gas, saw substantial price increases over this period, the prices reached by natural gas were utterly unprecedented. The following picture, sourced from Statista, shows the evolution of the monthly natural gas price index worldwide between January 2020 and December 2022:

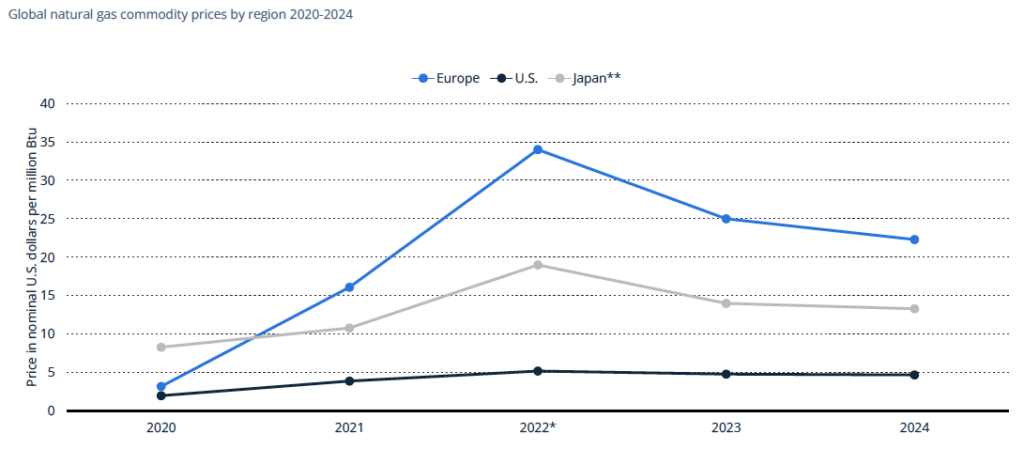

If this trend is regionally disaggregated, we see that the main price increases took place in Europe:

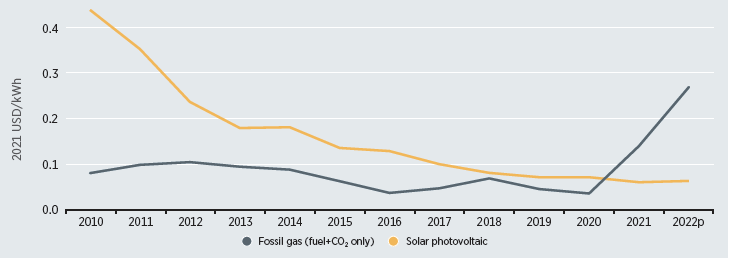

The massive increase in the prices of fossil fuel resources revived classic energy security fears, with their traditional responses, namely diversification of energy supply sources and efficiency or other consumption management policies. But the context of these responses today is very different from that of prior energy supply crises. More than the climate emergency, the short-term responses were particularly sensitive to the high costs of fossil fuels compared to the lower costs of electricity generated by renewable energy technologies, particularly wind and solar photovoltaic. The diversification of supply sources is thus taking place in a context where such technologies are mature and extremely competitive, even against ordinary (ie much lower) fossil fuel prices. To grasp this dimension, it is useful to refer to the concept of levelised cost of electricity (‘LCOE’), which provides an estimate of the average cost per unit of electricity generated across the lifetime of a new power plant. It allows comparison of costs across different forms of electricity generation technologies. The LCOE produced from renewable energy technologies decreased steeply in the decade before the Ukraine war, as a result of the socio-technical transformation driven by climate change.

According to a 2022 Report of the International Renewable Energy Agency (‘IRENA’):

‘[t]he period 2010 to 2021 has witnessed a seismic shift in the balance of competitiveness between renewables and incumbent fossil fuel and nuclear options. The global weighted average LCOE of newly commissioned projects utility-scale solar PV projects declined by 88% between 2010 and 2021, that of onshore wind and CSP by 68%, and offshore wind by 60%. In 2021, the global weighted average LCOE of new utility-scale solar PV and hydropower was 11% lower than the cheapest new fossil fuel-fired power generation option and that of onshore wind 39% lower.’ 6

The following figure, extracted from this report, compares the global weighted average LCOE of solar PV and gas-generated electricity (expressed in USD per kWh of electricity). The figures of 2022 are a possible projection, but the figure is useful, precisely, to show the underlying trend in which the energy crisis triggered by the Russian invasion of Ukraine intervened:

According to another report from the network REN21, in 2021, renewable energies generated 28.3% of global electricity, up from only 20.4% in 2011. 7 Of particular note, solar PV and wind energy technologies provided, for the first time, more than 10% of global electricity. However, electrical end-uses only accounted for 17% of total final energy consumption (‘TFEC’), with the largest share of TFEC coming from thermal uses (51%), followed by transportation uses (32%), where the share of renewables is much smaller. The share of renewables in TFEC varies widely across countries. It is noteworthy that the share of renewables in TFEC in large emitters of greenhouse gases such as China, the US, India, Russia and most EU countries remains below 20%. 8 Moreover, as discussed later in this article, the increase in fossil fuel prices from late 2021 onwards led to additional investment in fossil fuel infrastructure, which if effectively put to use may ‘lock in’ future emissions or, alternatively, result in massive stranded assets.

Thus, from the perspective of energy prices, the price signals are unclear. If a direction can be discerned in recent developments, it is not that fossil fuels are the cheapest way of producing energy. Quite to the contrary, fossil fuels have emerged as the most expensive way of doing so, in the short term. In the electricity sector, renewable energy technologies have been instrumental in making prices lower, but their role in thermal services and, above all, transportation, is still limited, although growing. Under these circumstances, the assumption that fossil fuel prices are the key to cheap energy is inaccurate and, even if fossil fuel prices decrease significantly in the medium- and long-term, the even more significant decrease in renewable energy prices, together with their growing use for thermal and transportation, makes that assumption far from obvious.

2- An ‘energy trilemma’ no longer?

For over a decade now, the World Energy Council has maintained a ‘World Energy Trilemma’ index. 9 The concept of an energy trilemma postulates the existence of tensions between policies aimed at achieving three different goals, namely energy security (the ability of a country ‘to meet current and future energy demand reliably’), energy equity (the ability of a country ‘to provide universal access to affordable, fairly priced and abundant energy for domestic and commercial use’), and environmental sustainability (the transition of a country’s energy system ‘towards mitigating and avoiding potential environmental harm and climate change impacts’). 10

The term ‘trilemma’ may be intriguing, but it is inaccurate. Achieving each of these goals is not mutually exclusive. Moreover, even when tensions arise, their degree and nature would require a more granular grid. For example, low-carbon nuclear energy mitigates climate change impact but pollutes the environment when considered from the perspective of nuclear waste. Moreover, there are important goals of energy policy, such as the safety of the installations, which are not represented in the trilemma. Despite these shortcomings, the concept is useful because it captures a commonly held perception that a country cannot choose, at the same time, eg sustainability and affordability or energy security and sustainability. The assumptions underlying the framing of the problem as a ‘trilemma’ are that only a fossil fuel energy matrix is affordable and secure enough to provide the electricity, transport and thermal products needed by a country (see discussion in the previous section). The very terms of the ‘trilemma’ assume that fossil fuel-based energy, although less sustainable, is more affordable and the only approach genuinely capable of ensuring security of supply.

The accuracy of these assumptions largely depends upon circumstances, such as the specific energy endowments, the system and infrastructure of a given country, the uses of energy (electricity, transportation, thermal) and the time-frame (short, medium, long-term). Moreover, technological change and diffusion can fundamentally challenge the ‘zero sum game’ perspective of the relations between the three terms of the trilemma. In the specific context of the energy crisis catalysed by the Russian invasion of Ukraine, the ‘trilemma’ lens has significant shortcomings. Whereas the urges of energy security in the very short-term have indeed given added momentum to new investment in fossil fuels, coal, oil and gas, they have also shown that fossil fuels can quickly become unaffordable, interrupt security of supply, while at the same time harming the environment, including the climate system. In such a case, a focus on fossil fuels would not satisfy any of the terms of the trilemma. Conversely, with wind energy (both onshore and offshore) and solar photovoltaic technologies now sufficiently mature, reliance on such sources can overperform fossil fuels not only in terms of environmental sustainability, but also of equity (including affordability) and, remarkably, security of supply. That does not remove the complex interactions between energy policy goals, including the potential tensions between two or more of them, but it does emphasise the important limitations of the ‘energy trilemma’ lens. Maintaining such lens may well feed a political narrative that supports additional investment in fossil fuels, at a time when radical transformation away from them is needed.

The increasing alignment of energy security with both sustainability and affordability has not gone unnoticed. In its World Energy Outlook 2022, the IEA notes that:

‘[i]n the most affected regions, higher shares of renewables were correlated with lower electricity prices, and more efficient homes and electrified heat have provided an important buffer for some – but far from enough – consumers.’ 11

Later on, it states, more explicitly, that the alignment is not a passing phenomenon:

‘[e]nergy markets and policies have changed as a result of Russia’s invasion of Ukraine, not just for the time being, but for decades to come. The environmental case for clean energy needed no reinforcement, but the economic arguments in favour of cost-competitive and affordable clean technologies are now stronger – and so too is the energy security case. This alignment of economic, climate and security priorities has already started to move the dial towards a better outcome for the world’s people and for the planet.’ 12

In a similar vein, REN21’s Renewables Global Status Report 2022 also emphasises the alignment of the economic, security and environmental rationales:

‘a strong synergy exists between measures needed to improve energy security and those associated with the energy transition, and especially the shift to renewables. High levels of locally produced renewable energy, coupled with energy saving and better energy efficiency, improve energy security, sovereignty and diversity. This helps to reduce exposure to energy price fluctuations while at the same time reducing emissions and providing other economic benefits.’ 13

In IRENA’s World Energy Transitions Outlook 2022, the potential of the alignment of these goals is also emphasised:

‘[a]cceleration of the energy transition is also essential for long-term energy security, price stability and national resilience. Some 80% of the global population lives in countries that are net energy importers. With the abundance of renewable potential yet to be harnessed, this percentage can be dramatically reduced. Such a profound shift would make countries less dependent on energy imports through diversified supply options and help decouple economies from wide swings in the prices of fossil fuels. This path would also create jobs, reduce poverty, and advance the cause of an inclusive and climate-safe global economy.’ 14

These three authoritative reports are merely taking stock of an increasingly noticeable alignment of goals, not only in the exceptional circumstances of the post-pandemic and the Ukraine war, but, as noted in the World Energy Outlook 2022, ‘for decades to come’. Under such circumstances, assuming the existence of an ‘energy trilemma’ is misleading and, given its potential to fuel a pro-fossil fuels narrative, it should be subject to caution.

3- Race to the bottom, or to the top?

Assuming that fossil fuels are the cheaper and most competitive form of energy (whereas renewable energy technologies are expensive) and that the economic goals of energy policy are at loggerheads with sustainability goals (as implicit in the ‘energy trilemma’ lens) is at the roots of yet another long held assumption: that climate policies are bad for the economy and, as a result, countries around the World are engaged in a race to increase competitiveness by lowering their standards (so called ‘race-to-the-bottom’) and benefitting from other countries’ efforts to reduce emissions.

Such an assumption has been influential in policy circles. Shortly before the adoption of the Kyoto Protocol, the US Senate adopted—by 95 votes to 0—the Byrd-Hagel Resolution stating that:

‘the United States should not be a signatory to any protocol … which would (A) mandate new commitments to limit or reduce greenhouse gas emissions for the Annex I Parties, unless the protocol (…) also mandates new specific scheduled commitments (…) for Developing Country Parties within the same compliance period, or (B) result in serious harm to the economy of the United States.’ 15

The US signed but never ratified the Kyoto Protocol. When, years later, President Bush repudiated the instrument, he noted that he:

‘oppose[d] the Kyoto Protocol because it exempts 80 percent of the world, including major population centers such as China and India, from compliance, and would cause serious harm to the US economy.’ 16

More recently, the assumption that it is economically advantageous not to adopt climate policy—ie to continue reliance on ‘cheap’ and ‘secure’ fossil fuels —and ‘free-ride’ the efforts of other countries taking mitigation action has found expression in unexpected ways. In 2015, environmental economist W. Nordhaus argued for the establishment of ‘climate clubs’ on the grounds that:

‘it has up to now proven difficult to induce countries to join in an international agreement with significant reductions in emissions. The fundamental reason is the strong incentives for free-riding in current international climate agreements. Free-riding occurs when a party receives the benefits of a public good without contributing to the costs. In the case of the international climate-change policy, countries have an incentive to rely on the emissions reductions of others without taking proportionate domestic abatement.’ 17

This idea has been taken up by the G7 in its ‘Statement on Climate Club’ of June 2022, announcing the aim:

‘to establish a Climate Club to support the effective implementation of the Paris Agreement by accelerating climate action and increasing ambition, with a particular focus on the industry sector, thereby addressing risks of carbon leakage for emission intensive goods, while complying with international rules.’ 18

The implicit understanding in this Statement and in Nordhaus’ contribution is summarised by two authors in the following terms:

‘[w]hile there are significant collective benefits associated with climate change mitigation, climate policy imposes concentrated costs on early movers who, nevertheless, only capture a small fraction of their actions’ global benefits’ 19

This assumption is questionable. It understates the fact that low-carbon energy policy may have important environmental and health benefits which are specific to the country taking action and, no less importantly, it entirely omits the specific economic benefits associated with ‘green industrial policies’. Low-carbon energy policies in sectors such as solar PV, wind energy, energy efficiency and electrification of thermal and transportation services are not a mere ‘burden’. 20 Rather, they have been shown to be highly beneficial in economic and strategic terms, raising the question as to what ‘race’ are countries running. 21 On the evidence, a new race ‘to the top’, ie to reap the benefits of an early mover in low-carbon technologies and industries, is becoming increasingly discernible alongside the ‘locked-in’ rigidities of investment in fossil fuels.

In late 2019, the European Commission published a Communication entitled ‘The European Green Deal’, which it described as a:

‘new growth strategy that aims to transform the EU into a fair and prosperous society, with a modern, resource-efficient and competitive economy where there are no net emissions of greenhouse gases in 2050 and where economic growth is decoupled from resource use’. 22

The EU Green Deal expressly aims to design a ‘set of deeply transformative policies’ for ‘clean energy supply across the economy, industry, production and consumption, large-scale infrastructure, transport, food and agriculture, construction, taxation and social benefits.’ Transforming the energy system into a low-carbon one is a particularly important aspect of the EU Green Deal. The EU’s carbon neutrality (net zero) target by 2050 was subsequently enshrined in the so-called ‘European Climate Law’. 23 A legislative package was then proposed by the Commission in July 2021, known as the ‘Fit for 55’ (ie by reference to the pledge to reduce GHG emissions by at least 55% by 2030, as compared to 1990), with a strong focus on the development of renewable energies, increased energy efficiency (including building renovation), and the electrification of the economy (particularly the transport sector).

With the outbreak of war in Ukraine and the increase in the price of fossil fuels, the Commission doubled down on its goal to transform the Union’s energy matrix. In May 2022, the Commission published a new communication on REPowerEU, with a focus on achieving energy savings, diversifying energy suppliers (away from Russia) and accelerating the roll out of renewable energies. 24 A few months later, in August 2022, the US adopted the Inflation Reduction Act (‘IRA’), which contains very substantial measures to incentivise energy efficiency, electric transportation and renewable energies. 25 One should not underestimate the extent of the intellectual shift underlying this major piece of ‘industrial policy’ adopted by the US federal government in a country where industrial policy has long been considered anathema.

Interestingly, the IRA is a major challenge to the ambitions of the EU to become competitive in the green sector. This is because its financial incentives could attract part of the European industry to the US. The ability of EU countries to provide financial incentives as a means of industrial policy is limited by EU State aid rules. Yet, in a bold move signalling the increasing focus on green industrial policy, the EU has recently published a communication laying out ‘A Green Deal Industrial Plan for the Net Zero Age’, 26 which includes the possibility of adjusting State aid rules following a consultation. The rationale for this plan is stated clearly in the introduction, in a text that deserves to be quoted in extenso:

‘(…) Europe’s partners are also beginning to seize the net- zero industrial opportunities. The United States’ Inflation Reduction Act will mobilise over USD 360 billion by 2032 (approximately EUR 330 billion). Japan’s green transformation plans aim to raise up to JPY 20 trillion (approximately EUR 140 billion) – through ‘green transition’ bonds. India has put forward the Production Linked Incentive Scheme to enhance competitiveness in sectors like solar photovoltaics and batteries. The UK, Canada and many others have also put forward their investment plans in clean tech technologies. Europe is committed to working with all of those partners for the greater good.

However, trade and competition on net-zero industry must be fair. Some of our partners’ initiatives can have undesired collateral effects on our own net-zero industries. More fundamentally, China’s subsidies have long been twice as high as those in the EU, relative to GDP3. This has distorted the market and ensured that the manufacturing of a number of net-zero technologies is currently dominated by China, which has made subsidising clean tech innovation and manufacturing a priority of its Five-Year Plan. China’s pipeline of announced investments in clean technologies exceeds USD 280 billion (approximately EUR 260 billion). Europe and its partners must do more to combat the effect of such unfair subsidies and prolonged market distortion. Where the public footprint in private markets is outsized, distortions create an unlevelled playing field and unfair competition emerges. The Commission will continue to make full use of trade defence instruments (TDI) to defend the Single Market, and rules-based international trade, from unfair trade practices like dumping and distortive subsidies.’ 27

Whereas it may be easier to finger-point China rather than ‘Europe’s partners’ in the text, this communication clearly signals a deeper shift in how low-carbon policies are framed: as green industrial policy to enhance the competitive edge of early movers. This is very different from the prior narrative. Some aspects of both narratives overlap to some extent, in that becoming competitive in low-carbon technologies may benefit from some degree of protection in the form of carbon equalisation measures at the border, as in a climate club. But, from a policy perspective, it is the opposite of a competitive ‘race-to-the-bottom’ framing. Even China’s actions portrayed as market distortions are, in fact, low carbon energy policies.

4- Three assumptions not to be assumed

The significance of the Ukraine war for the energy transition must be assessed in its wider context. Despite its apparent similarity with the weaponization of oil supplies in the 1970s, the context of the war is fundamentally different.

Part of this difference comes from the need to revisit the three long held assumptions of energy policy discussed in this brief contribution. This is because, on the evidence, fossil fuels can no longer be assumed to be the key to cheap energy, the purported ‘energy trilemma’ may not be one, and the most important race in the years to come may not be to the bottom, but to the top.

Revisiting these three assumptions does not, as such, provide an answer to the question of whether the current crisis threatens the viability of the ongoing energy transition. But it does change the parameters of possible answers. The search for such answers belongs to each political community. Political decision-making, including in matters of economic, energy and environmental policy, is largely influenced by policy assumptions that sometimes remain surprisingly unchallenged. The current energy crisis offers a clear perspective on why some influential assumptions of energy policy need to be corrected.

Notes

- IEA, World Energy Outlook 2022, Executive Summary, at 26.

- According to the Global Recovery Observatory (‘GRO’), as of August 2022, USD 18.16 trillion had been spent on COVID-19 fiscal stimulus in the 89 countries monitored since the beginning of the pandemic. Of these, USD 15.05 trillion went into short-term ‘rescue’ policies and only USD 3.11 trillion were spent on longer term ‘recovery’ measures. Only a third of these USD 3.11 trillion (USD 0.97 trillion) qualified as ‘green spending’, understood by reference to the associated emissions of greenhouse gases (GHG), air pollution and impact on natural capital. See the website of the Global Recovery Observatory, available at: https://recovery.smithschool.ox.ac.uk/tracking/

- See eg the global commodity price index (2013-2021, with forecast to 2024) calculated by Statista : https://www.statista.com/statistics/252795/weighted-price-index-of-energy/

- World Bank, Commodity Markets Outlook, October 2022, Executive Summary, at 1.

- IEA, World Energy Outlook 2022, at 29.

- IRENA, Renewable Power Generation Costs in 2021 (July 2022), Executive Summary, at 2.

- REN21, Renewables 2022. Global Status Report, at 22.

- REN21, Renewables 2022. Global Status Report, at 41.

- World Energy Council, World Energy Trilemma Index 2022: https://www.worldenergy.org/transition-toolkit/world-energy-trilemma-index

- The text is quoted from the WEC’s website.

- IEA, World Energy Outlook 2022, Executive Summary, at 20.

- IEA, World Energy Outlook 2022, Executive Summary, at 26.

- REN21, Renewables Global Status Report 2022, at 38.

- IRENA, World Energy Transitions Outlook 2022, at 15.

- S.Res.98 — 105th Congress (1997-1998), agreed on 25 July 1997, available at: https://www.congress.gov/bill/105th-congress/senate-resolution/98/text

- Letter from the President to Senators Hagel, Helms, Craig, and Roberts, 13 March 2001, available at: https://georgewbush-whitehouse.archives.gov/news/releases/2001/03/print/20010314.html

- W. Nordhaus, ‘Climate Clubs: Overcoming Free-Riding in International Climate Policy’ (2015) 105(4) American Economic Review 1339.

- G7 Statement on Climate Club, Elmau, 28 June 2022, available at : https://www.g7germany.de/resource/blob/974430/2057926/2a7cd9f10213a481924492942dd660a1/2022-06-28-g7-climate-club-data.pdf

- M. Aklin, M. Mildenberger, ‘Prisoners of the Wrong Dilemma: Why Distributive Conflict, Not Collective Action, Characterizes the Politics of Climate Change’ (202) 20(4) Global Environmental Politics 4.

- M. Grubb et al, The New Economics of Innovation and Transition, EEIST November 2021

- J.-F. Mercure et al., ‘Reframing incentives for climate policy action’ (2021) 6 Nature Energy 1133.

- Communication from the Commission, The European Green Deal, COM(2019) 640 final, 11 December 2019.

- Regulation (EU) 2021/1119 of 30 June 2021 establishing the framework for achieving climate neutrality and amending Regulations (EC) No 401/2009 and (EU) 2018/1999.

- Communication from the Commission, REPowerEU Plan, COM(2022) 230 final, 18 May 2022.

- Inflation Reduction Act, Public Law 117–169—AUG. 16, 2022.

- Communication from the Commission, A Green Deal Industrial Plan for the Net Zero Age, COM(2023) 62 final, 1 February 2023.

- Communication from the Commission, A Green Deal Industrial Plan for the Net Zero Age, COM(2023) 62 final, 1 February 2023, at 2 (emphasis added).

citer l'article

Jorge E. Viñuales, The Ukraine war and the energy transition, Jun 2023,

à lire dans cette issue

voir toute la revue