Issue

Issue #1Auteurs

Mathilde Teissonnière

21x29,7cm - 153 pages Issue #1, September 2021

China’s Ecological Power: Analysis, Critiques, and Perspectives

China’s nuclear program is one of the most recent major civil nuclear programs. In forty years, China has managed to gain sufficient maturity to develop its own nuclear technologies and position itself in the international market. It has developed by following the now well-known and much feared principle of “importation, assimilation, sinicization and innovation”. Today, the country is the third largest civil nuclear power in terms of installed capacity with 51 GWe, and is expected to rise to be the number one producer in the coming decade, ahead of the United States and France.

The Long March of Chinese Nuclear Power

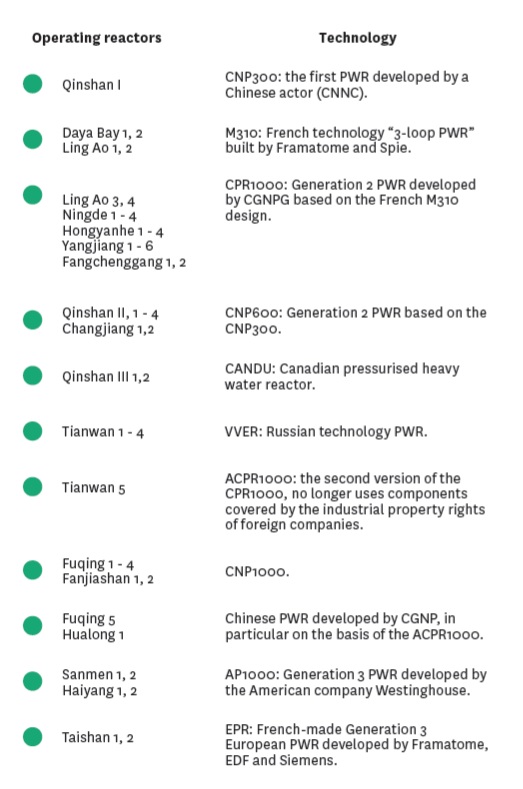

The Chinese nuclear program initially began for military purposes in the 1950s with the help of the USSR. Despite cooling relations between the two communist regimes, the project was launched and led to its first atomic bomb test on 16 October 1964. It was only after the Cultural Revolution in 1982 that China decided to build its first small, civil nuclear power plant of 300 MWe at the Qinshan site (Zhejiang province), equipped with a pressurised water reactor (PWR).

China first invested in foreign technologies, which it copied and then appropriated to move upmarket. At that time, France appeared to be a strong partner to China.

In 1982, the Chinese Ministry of Nuclear Industry (MNI) and the French Atomic Energy Commission (AEC) signed a “cooperation agreement in the matter of atomic energy’s peaceful use.” In 1983, a memorandum of nuclear power cooperation was signed, which included the construction of several 900 MW reactors using French technology and contained a clause on technology transfer to China. 1 Other countries also contributed their technologies, such as Canada with its CANDU reactor (Qinshan III nuclear power plant, connected in 2003) and Russia with VVER (two reactors at the Tianwan power plant brought into operation in 2006-2007). During the construction of the Daya Bay plant (two reactors brought into operation in 1993-1994), French technology was chosen as a model for the Chinese Generation 2 reactor system. The Daya Bay nuclear station’s technology (3-loop PWR, 900MW) and Framatome’s fuel fabrication technology (AFA-2G and AFA-3G) have been used as a basis for the Chinese CPR1000 reactors, sixteen units of which are currently in service.

In total, eight reactors were built between 1991 and 2003 with four of them being built in partnership with French companies. 2

Nuclear Power Comes of Age

It was not until a push by President Hu Jintao and his Prime Minister Wen Jiabao in 2003 that the country really began to invest in nuclear technology. In 2004, China launched a request for bids to establish the new Generation 3 standard for its electronuclear power fleet. It chose the AP1000 from the American company Westinghouse and construction of the first four reactors began in 2009-2010 at the Sanmen and Haiyang sites. At the same time, the French EPR was chosen for the Taishan unit 1 and 2 projects.

Thanks to a policy of localisation and technology transfer, some components of the AP1000 and the EPR are produced domestically. China’s dependence on foreign technologies was reduced throughout the 2000s, with improved quality of its equipment and a mastery of expertise. Today, China controls the entire industrial supply chain for manufacturing the different parts of a power plant. 3

Armed with these advances, the Chinese authorities decided to move towards a domestic reactor model. The China National Nuclear Corporation (CNNC) and the China General Nuclear Power Corporation (CGN), the two main state-owned businesses in the Chinese nuclear industry, took advantage of this to develop and bring their models up to standard, the ACP1000+ and the ACPR1000+ respectively, which were themselves derived from the French M310 reactor at Daya Bay.

After the Fukushima accident in 2011, China put its nuclear programme on hold. Its State Council suspended approvals for new power plants and declared that only Generation 3 reactors could be built. All new projects must meet higher safety standards, including dual passive and active reactor safety. To satisfy this requirement, in 2014 the government asked CGN and CNNC to merge their two reactor designs into a unified technology under the name Hualong One. The first plans for these reactors were approved and construction of Fuqing units 5 and 6 for CNNC and Fangchenggang units 3 and 4 for CGN began in 2015. 4

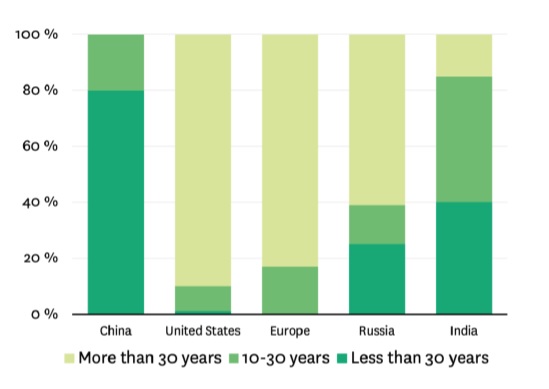

Figure 1 • AGE profile of nuclear power capacity 5

With forty-nine reactors currently in operation, nuclear power represents 4.9% of China’s electricity mix. If the percentage of nuclear power seems low, it is important to put it into context: China is the world’s largest producer of electricity. According to data from the International Energy Agency, in 2019, electricity production in France was 537.7 TWh, compared to 7140 TWh for China in the same year. Electricity produced solely by nuclear power in China therefore accounted for about 65% of France’s total electricity production in 2019.

Unlike France, whose electricity mix is 70% nuclear, China has not chosen to make this its main energy resource. As the country has significant access to coal, an abundant and inexpensive resource, there was no real incentive in the previous decade to move towards cleaner energy. The challenge of climate change is now pushing China to begin its transition by diversifying its energy mix through solar and wind energy, whose prices have dropped considerably in recent years. Despite coal still comprising a major share of the electricity mix (around 60%), the objectives announced by Xi Jinping to reach peak CO2 emissions in 2030 and carbon neutrality in 2060 6 ensure that nuclear energy will have a permanent place in China’s future electricity mix.

Unveiled in March 2021, the 14th Five-Year Plan (2021-2025) 7 plans for 70 GW of installed nuclear power capacity in operation by 2025. Therefore, an additional 19 GW must be connected to the grid, i.e. the construction of four reactors per year over the next five years. Despite halting inland power plant projects along rivers 8 , China is not making a risky gamble; the country already has twelve units under construction, more than half of the reactors it needs to reach its target.

Outlook: China’s Nuclear Industry Seeks Autonomy and Internationalisation

During the two sessions of the National People’s Congress held in March 2021, nuclear energy was designated as an indispensable tool for building “a modern energy system” 9 where third- or fourth-generation power plants will have a role to play in the electricity sector and beyond (production of urban heating, hydrogen, etc).

To achieve its objectives, China wants to close its nuclear cycle and control its entire industry. On the one hand, it is securing its uranium supply by buying up mines in Africa and producing its fuel in its own plants in Inner Mongolia and Sichuan. On the other hand, it is creating storage sites for low-level radioactive waste and wants to invest in a reprocessing plant. The Chinese authorities are again looking to France, this time to recycle uranium and plutonium into mixed fuels (called MOX), thanks to an facility modelled on Orano’s MELOX plant in Marcoule. 10

In order to solidify nuclear energy’s place within a legal framework and to manage a policy that safeguards the country’s needs, two laws are being prepared. The first one, on atomic energy, is essential to frame and promote the development of nuclear energy. The second law in preparation, “Regulation on the Management of Spent Nuclear Fuel”, is in line with the objective of closing the cycle and the “efficient and organized” treatment 11 of spent fuel.

A significant budget is allocated to controlling the back end of the cycle, as well as to research on Generation 4 reactors. Fast neutron reactors (FNR), small modular reactors (SMR), and fusion reactors are all research projects in which China is investing on a large scale. Today there are eight SMR projects, five of which are particularly far along. 12 In addition to providing electricity production in isolated locations, China sees this technology as a way to export these small reactors to countries that are newcomers to the civil nuclear market.

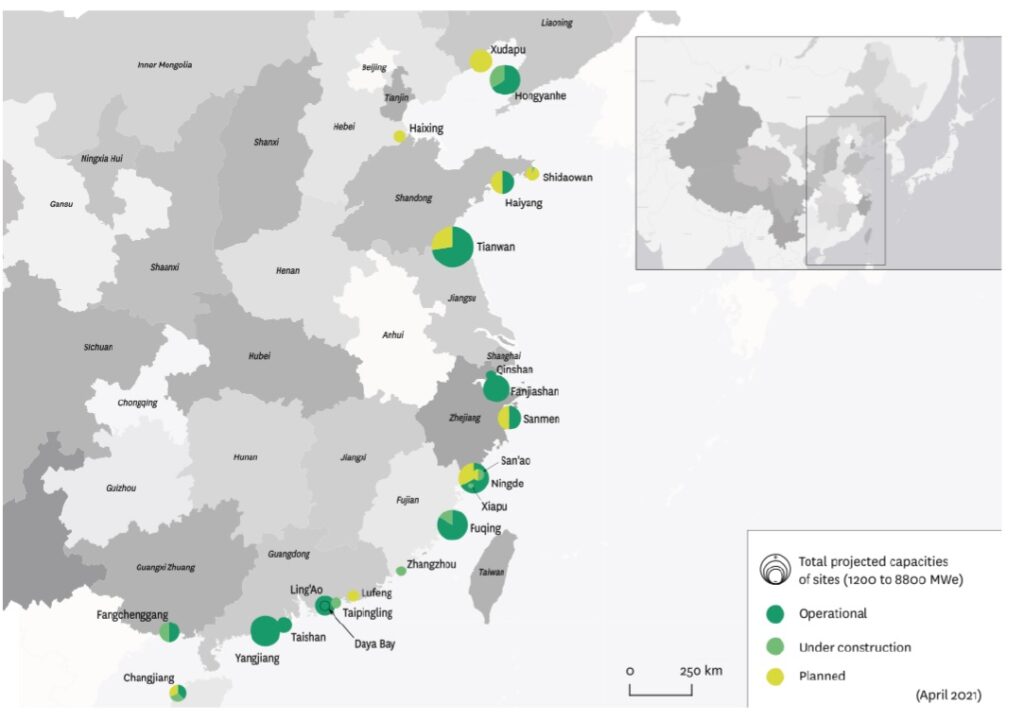

Figure 2 • Locations of chinese nuclear power plants

However, China is not losing sight of the advantages of higher power reactors. The domestic Hualong has become the standard technology for Chinese nuclear reactors. With sixteen Hualong One reactors under construction or planned in the country (ranging in power from 1080 to 1200 MWe), and two more under construction in Pakistan, China should benefit from the effect of mass-production allowing it to reduce even further the cost of its 100% Chinese reactor. Moreover, it has managed the feat of building its first Generation 3 reactor in just 68 months (between breaking ground and the start of commercial operation in January 2021).

To take advantage of these effects, the country is seeking to export its model. Despite a first contract with Pakistan for two units at the Karachi nuclear power plant (whose first one is expected to come on line in late April 2021), China is struggling to internationalise its reactor technology. To date, the Hualong reactor has also been proposed to the Czech Republic, Poland, Kenya, and Argentina, but without success.

The plan to build a Hualong-1 at the UK’s Bradwell site could give China the credibility it is looking for. 13 The Hualong-1 must first pass the Generic Design Assessment (GDA), the certification issued by the UK nuclear safety authority. The National Nuclear Safety Administration (NNSA), the Chinese body in charge of nuclear safety, collaborates with other safety bodies of the major nuclear countries; this is the case with the Nuclear Regulatory Commission in the United States and the Agence de Sûreté Nucléaire (ASN) in France. China is also an active member of the International Atomic Energy Agency (IAEA), which sets common standards for the nuclear industry. The issuing of a GDA certification for the Hualong-1 and the subsequent construction of one of these 100% Chinese reactors would be a very important measure of credibility for China and would enable it to establish itself as a nuclear power exportation country alongside Russia, Korea, France, and the United States.

Notes

- P. Y. Cordier, “Historique de la coopération franco-chinoise”, La Revue Générale Nucléaire, n°5, September-October 2017.

- PRIS, Power Reactor Information System (website), IAEA.

- La Revue de l’Énergie, n° 624, March-April 2015.

- “China successfully develops first Hualong One nuclear reactor”, China Daily, November 2017.

- Source : IEA, 2019.

- Xi Jinping’s speech to the UN on 22 September 2020.

- 14th Five-Year Plan, Tsinghua University, 2021.

- Since Fukushima, the government has indefinitely frozen plans for riverside power plants in the face of public opposition and concerns about river pollution and water use during droughts. The 14th Plan again rules out the resumption of these projects for the next five years, J. Timperley, “Will China Gamble on a Nuclear Future ?”, Energy Monitor, March 2021.

- Interview with Gu Jun, Director General of the CNNC and Deputy Party Secretary for the Chinese news website Toutiao : “两会核声丨 顾军:中核集团将为碳达峰碳中和目标提供有力支撑”, Toutiao, March 2021.

- S. Huet, “Nucléaire : les ambitions chinoises”, {Sciences²}, Le Monde, June 2019.

- Ibid.

- Advances in Small Modular Reactor Technology Developments. A Supplement to IAEA Advanced Reactors Information System (ARIS) 2020 Edition, International Atomic Energy Agency, September 2020

- “Le Hualong-1 franchit une nouvelle étape au Royaume-Uni”, Revue Générale du Nucléaire, January 2019.

citer l'article

Mathilde Teissonnière, Civil Nuclear Energy in China, Sep 2021, 86-89.

à lire dans cette issue

voir toute la revue