Is China’s Oil Sector Oblivious to the Country’s 2060 Pledge?

Michal Meidan

Director of the China Energy Programme at the Oxford Institute for Energy StudiesIssue

Issue #1Auteurs

Michal Meidan

21x29,7cm - 153 pages Issue #1, September 2021

China’s Ecological Power: Analysis, Critiques, and Perspectives

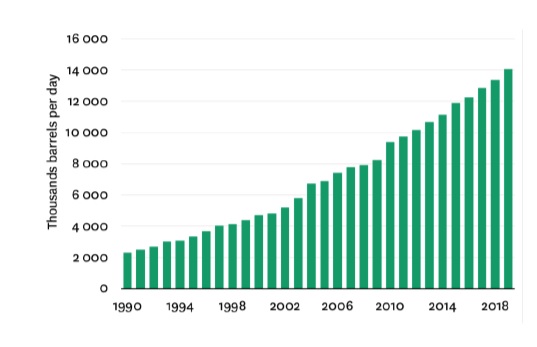

China’s oil demand has grown rapidly over the past three decades, as the country’s economic activity, industrial development and urbanisation levels have generated a seemingly insatiable appetite for oil. Indeed, the country’s oil use has surged from 2 mb/d in 1990 to 14 mb/d in 2019, according to the BP Statistical Review 1 , accounting for 14% of global oil use—which is now reaching 100 mb/d 2 —and representing almost half of global oil demand growth over that period. China is set to remain a key driver of oil demand as it likely overtakes the US as the world’s largest economy.

To be sure, the pace of the country’s oil demand growth is set to slow, while the makeup of oil product demand is shifting, alongside the restructuring of the Chinese economy and enhanced efforts to curb local air pollution. But the country’s recently announced pledge to peak carbon emissions by 2030 and to aim for carbon neutrality by 2060 may not alter this outlook substantially. This is because the government is still planning substantial economic growth over the next decade or so, supporting oil consumption. Moreover, the government’s increasing concerns over self-sufficiency and its desire to limit its dependence on imported petrochemicals (which are produced with oil), suggest the country’s petrochemical industry will remain a large consumer of oil for years to come.

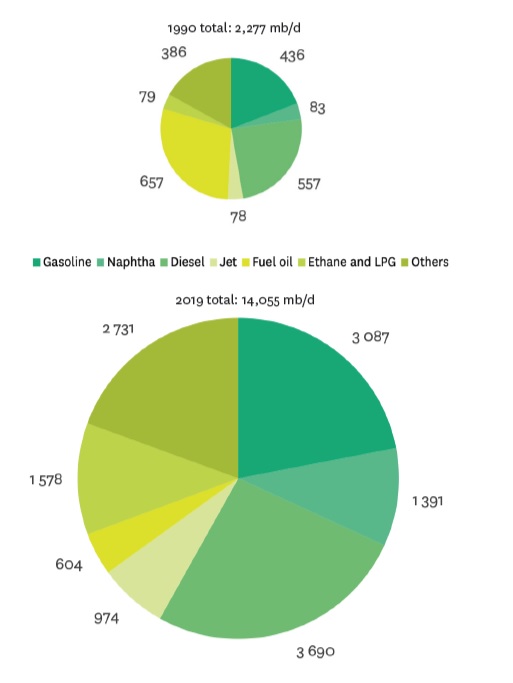

Oil demand still rising

Over the coming decade, China’s oil demand is estimated to rise by anywhere from 2-4 mb/d, a substantial volume in the global context, but a far cry from the 9-10 mb/d of growth recorded over the past two decades. 3 Moreover, in the 2030s it will start to fall. The expected strength in demand stems from the fact that per capita oil use in China is roughly a third of OECD levels and the share of oil in the energy mix, at under 20%, is also around half of that in most OECD countries. While oil penetration is likely to remain low by international standards due to structural declines in oil intensity—which tend to occur naturally as per capita GDP grows and in light of the Chinese government’s policy efforts—when considering that China today holds one fifth of global population and accounts for 15% of global GDP, the underlying fundamentals of China’s development suggest a growing oil demand profile. In particular, with the government pledging to double the size of the economy again by 2035 4 and urbanisation continuing, oil demand will remain strong. Rising incomes will drive demand for transport fuels such as gasoline and jet as well as for consumer goods. This marks a shift away from the consumption of industrial fuels such as diesel and fuel oil which have been the main tenets of oil use thus far. When looking further back, to the past 40 years or so, China’s oil use has changed considerably: in the early 1980s, more than 50% of China’s product slate consisted of fuel oil, used in industrial applications and heating, but was gradually displaced with diesel. The 2000s saw a steep rise in diesel consumption as construction activity and industrial output surged. The 2010s then saw a sharper move toward gasoline with rising demand for passenger cars and mobility. And as China’s population becomes wealthier and takes more flights, air travel and the related demand for jet fuel is set to increase. Finally, a more consumer-oriented society will drive demand for petrochemicals, used in the production of electrical appliances, in packaging (of consumer goods but also of food deliveries) and in medical equipment.

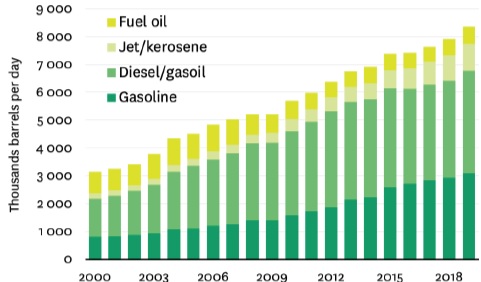

Historically, diesel consumption accounted for almost one-third of total oil use and has been the largest driver of China’s oil demand growth. Roughly one third of all diesel consumed in the country was used in industry, by mining and construction equipment for industrial activities as well as small-scale diesel generators, with an additional two-thirds in freight and commercial vehicles. But China’s industrial diesel demand (consisting of both diesel and historically of fuel oil too) is now peaking, as the economy is shifting from an investment-led economy to one driven by consumption. Any future growth in diesel demand is set to come overwhelmingly from freight and shipping—as diesel-fuelled trucks delivers goods across the country, but diesel consumption in construction and industry is set to slow. Here too, though, government policies are increasingly supporting diesel substitutions as part of the central government’s efforts to tackle local air pollution. For example, the central government is looking to encourage a move from road freight to rail and water, in a bid to limit tail-pipe emissions. In addition, the government is encouraging the use of LNG trucks and electric buses to replace diesel use in large freight and public fleets.

Figure 1 • evolution of china’s oil demand, thousands barrels per day 5

Figure 2 • China’s oil demand by selected products, thousand barrels per day 6

China’s state owned oil majors expect demand for transport fuels to peak in 2025 at around 14.6 mb/d , earlier than they had previously expected and at a slightly lower level of than the 14.8 mb/d 7 . So, the government’s twin 2030-2060 pledges have impacted the outlook slightly, but with demand for chemicals still rising, overall demand for oil products will continue to grow until the early 2030s and only then start to fall, with little change from previous forecasts.

When does it peak and how steep will the decline be?

Even as developed economies are looking at transitioning away from fossil fuels, emerging countries such as China are still expecting several years of growth. Environmental pledges combined with industrial programmes to electrify their vehicle fleets, for example, will determine when these countries’ oil demand will peak, and perhaps more importantly how rapidly it will decline thereafter.For China, part of the uncertainty lies in the country’s ambitious plans to electrify its vehicle fleet and its impact on gasoline demand. For example, between 2008 and 2018, due to the phenomenal growth of China’s private car fleet, gasoline demand grew by 1.7 mb/d, accounting for over a third of total product demand growth, according to NBS data, with diesel demand (for freight), jet fuel demand and chemicals all accounting for the remainder of growth. With a fleet of just over 200 million in 2020 and private car ownership well below Western levels, there is scope for the fleet to double again in the next twenty years. Yet gasoline use is set to grow at lower levels than those witnessed so far. This is due to China’s policies to curb local air pollution; its ambitions to become a technological leader in electric vehicles as well as changes in mobility, related to the development of the electric vehicle (EV) industry in China.

Figure 3 • China’s oil demand by products, 1990 vs. 2019 8

First, as air pollution has become a growing area of social consternation, the government has stepped up its efforts to limit local pollutants, with the transport sector a major focus. Government-mandated fuel economy standards in China continue to tighten. In 2010, average fuel consumption limits for passenger vehicles were 8.2 litres/100 km and are targeted to drop to 5.0 litres/100 km in 2020 and 4.0 litres/km in 2025. Second, the average fuel efficiency of the fleet is also rising as the share of electric vehicles in the fleet grows. Given that China’s new energy vehicle policy (NEV – including pure electric vehicles, plug in hybrids, natural gas vehicles and fuel cell vehicles) aims to support the country’s industrial upgrade programme as well as efforts to reduce local air pollution, NEVs have benefitted from strong government backing, which has, in turn, led to a rapid commercialisation of NEVs in the country.

As a result, China is currently the world’s largest electric car market with over 1.4 million electric cars sold in 2020 and a fleet of close to 5 million units. 9 At the same time, changing mobility habits are leading to a drop in vehicle miles travelled (VMT). Local governments have been restricting car ownership through lengthy and onerous procedures to gain license plates, which have helped increase the attractiveness of car sharing services, while shared bike apps alongside improved public transport have stimulated greater use of the public transport network.

Take Beijing municipality for example. Data from the local transportation research centre shows that VMT fell by half between 2004 and 2017. This is because as the fleet grew, traffic congestion worsened, dampening enthusiasm for driving. At the same time, public transit has improved, with Beijing growing its network dramatically between 2008 and 2016. During those years, Beijing’s population rose by 23% while subway ridership grew by more than 150%. At the same time, bike sharing apps, which have flourished in China, have further encouraged commuters to use the improved public transport networks, allowing them to start or finish their journey—“the first/last mile”—rapidly and easily.

In smaller cities, the electric two-wheeler (E2W) and low-speed electric vehicle (LSEV) markets have flourished. The IEA reckons that of the estimated global stock of 350 million electric two/three-wheelers, the majority are in China. 10 These mini-EVs may be defining mobility in China’s fourth- and fifth-tier cities as they do not require a driver’s licence to use and sell for as little as $1000 11 . Even though they are made of low-quality parts and lead-acid batteries—which may have other environmental downsides—they allow new drivers to make their leap into vehicle ownership, thereby also placing them on an electric mobility trajectory. The fate of the mini-EV market will also depend on government regulation, though, as it has developed despite government efforts: Beijing has been concerned about safety standards in mini-EVs and tried to regulate the market, with the large auto-makers also lobbying Beijing to restrict its growth. But even at a slower growth trajectory, mini EVs impact potential gasoline demand growth in the years ahead.

Efforts to electrify China’s vehicle fleet slowed slightly in 2020 due to the Covid-19 pandemic and changes to the subsidy scheme. But this trend now seems to be gaining pace once more in light of worsening tensions with a number of Western countries and concerns about technological decoupling. What is more, President Xi’s 2030 and 2060 pledges are also pointing to an acceleration of efforts to electrify Chinese cities and energy end-use. The government’s New Infrastructure plan, issued in 2020, sets the stage for the country’s short-term recovery efforts and its long-term development. It focuses on seven specific fields: 5G networks, data centres, artificial intelligence, the industrial Internet of Things, ultra-high voltage power transmission, high-speed rail, and electric vehicle charging infrastructure.

Already in March, prior to the carbon neutrality pledge, China’s top economic planning body, the National Development and Reform Commission (NDRC), announced that it will accelerate the country’s transition to NEVs. In response to weaker NEV sales in 2020, the government launched a campaign in July that year to spur purchases in rural areas through road shows and discounts. At the same time, carmakers are offering affordable entry-level models and free charging point installation services, targeting first time buyers and rural consumers who have lower driving range requirements but also access to space for charging facilities. 12 As such, in the post-Covid-19 recovery plan, efforts to add charging infrastructure and create a robust digital and technological ecosystem for electric fleets is accelerating the uptake of electric mobility. Already, greater use of artificial intelligence and big data technologies has led to a surge in the use of e-bike and e-scooter sharing platforms in Chinese cities in the aftermath of the Covid-19 outbreak. According to data from bike-sharing companies, before the pandemic, riders looked to bike sharing for the “first” or “last” mile from their home or office to the train stop but now, they are shunning public transport and preferring to take the whole journey by bike. The addition of e-bike and e-scooter sharing platforms makes longer journeys more convenient. 13 With a faster roll-out of sharing platforms and more charging infrastructure, more new drivers may now be on an electric mobility trajectory, albeit with a wide variation between provinces in terms of affordability and range of models. Also, given the differences in local government support for charging infrastructure, both for private and public fleets, the picture across the country is likely to vary. 14

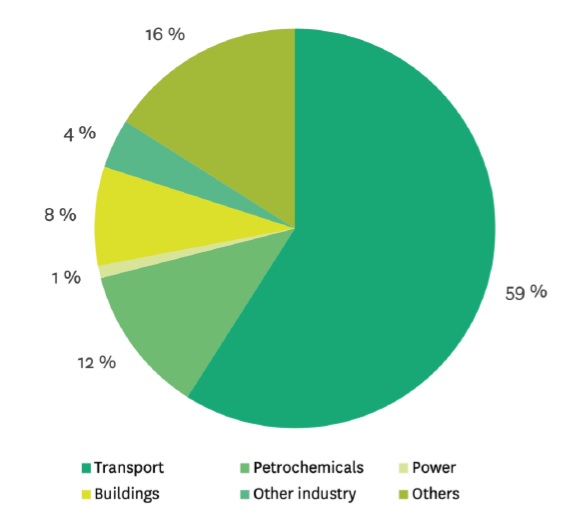

Figure 4 • End use for oil in china in 2018 15

This combination of new infrastructure to support the post-Covid 19 recovery and the added momentum around China’s climate ambitions suggest a focus on NEV production and sales as well as the infrastructure to enable a rapid rollout. Indeed, the Chinese government would like NEVs to account for 20% of new vehicle sales by 2025. So if gasoline demand in China was previously expected to peak in the late 2020s at around 3.5-3.6 mb/d, it may now peak in the mid-2020s at a slightly lower level of around 3.4 mb/d. But gasoline use is unlikely to drop sharply for several years thereafter: First, for NEVs to account for roughly 20% of sales by 2025, sales would need to more than double from current levels (assuming overall vehicle sales stabilise), requiring a massive scaling up of the supply chain. Already in 2021, though, a shortage of semiconductors is plaguing auto production in the country suggesting that supply chains could become a constraint to rapid growth. In addition to constraints to NEV manufacturing—due to potential raw material constraints—charging infrastructure will need to be rolled out and added rapidly; connections to the grid will need to be made and power supplies adjusted. 16 What is more, even with 20% of new sales provided by NEVs, there would still be a large internal combustion engine vehicle fleet. Put simply, NEVs will chip away at new sales, but will take time to displace the over 200 million strong vehicle fleet.

Refining capacity still growing

With oil demand therefore still expected to grow, albeit at a slower pace and likely peaking earlier than previously estimated, China’s refining system continues to grow. In stark contrast to refinery shutdowns globally, there are over 2 mb/d of new refining additions planned through 2025 in China. 17 For now, the government shows no sign of slowing the pace of refining starts, in part because new plants are being built by private companies – as part of the government’s effort to open the sector to non-state actors – and because they are integrated petrochemical plants, which support the government’s goal of self-sufficiency in chemicals. This switch to petrochemical output has been in the making for several years, with the state-owned refiners also looking to value-added products to help them compete in the global market and maximize profitability. This suggests that China’s demand for crude oil as a refinery feedstock will continue to grow for as much as a decade and when it peaks, will flatline before falling.

Conclusion

While Covid-19 cast doubts about China’s economic recovery and appetite for oil, its strong economic rebound has led to a surge in oil use. And despite the government’s 2030 and 2060 climate pledges, oil use due to a rapid urbanization and a rising middle class will continue to increase, even though growth rates will be tempered by the government’s commitment to curbing pollution. Small changes to mobility trends, and even gradual shifts from road freight and air travel to rail, will weigh on China’s demand growth through 2040, bringing China’s consumption higher by closer to 3 mb/d than to 4 mb/d. Refiners, in light of the excess product supply domestically, are aligning themselves with the government’s ambition to shift towards specialty-chemical growth, reflecting the increasing sophistication of consumer demand and China’s industrial output.

Covid-19 seems to have exacerbated the product oversupply and accelerated the shift to chemicals. Going forward, the government’s twin focus on economic recovery and accelerated electrification of energy end-uses could soften the outlook for oil demand. Electrification will be supported by efforts to add charging infrastructure and the creation of a robust digital and technological ecosystem, which in turn could support shared e-mobility. Despite this altered outlook, however, China will remain a key driver of oil demand growth for another few years, and thereafter will remain one of the largest oil importing countries in the world.

Notes

- BP Statistical Review of World Energy, 2020.

- According to OIES research based on CNPC, IEA, BP. Estimates for China’s oil demand growth vary among institutions but are taken here to include oil products and chemicals. It is also important to note that different conversion rates from Mt to bpd can alter the outlook. Regardless of the variations, most estimates see China’s oil demand rising by 15-25% over the course of the next decade before peaking and then falling.

- Based on BP Statistical Review (2020) data and China’s National Bureau of Statistics data.

- “Xi says China’s economy has hope, potential to maintain long-term stable development”, Xinhua, Novembrer 2020.

- Source: BP Statistical Review 2020, BP, 2020.

- Source: Ibid.

- CNPC 2050 Outlook, 2020.

- Source : BP Statistical Review 2020, BP, 2020.

- H. Hui, J. Lingzhi, “How China put nearly 5 million new energy vehicles on the road in one decade” ICCT Blog, January 2021.

- “Global EV Outlook 2020”, International Energy Agency, 2020.

- G. Collins, “Low-Speed Electric Vehicles: An Underappreciated Threat to Gasoline Demand in China and Global Oil Prices?”, Rice University’s Baker Institute for Public Policy issue brief, May 2019.

- A. Limin, D. Jia, “China Eyes Rural Market to Expand NEV Sales”, Caixin, July 2020.

- W. Ma Wenyan, “Here are 4 major bike-sharing trends from China after lockdown”, World Economic Forum, July 2020.

- A number of provinces have committed to electrifying their public fleets while others are focusing on private charging infrastructure, the regional profile in China varies. See for example: J. Lingzhi Jin, H. Hui, “Comparison of the electric car market in China and the United States”, ICCT working paper, 2019.

- Source: BP Statistical Review 2020, BP, 2020.

- Connecting EVs to the grid is also an opportunity to decarbonise the grid. See for example : B. Finamore, B. Mi Kim, “How EV Charging Can Clean Up China’s Electricity Grid”, NRDC Blog, June 2020.

- “China’s oil product demand to peak by 2025: Sinopec”, Argus Media, December 2020.

citer l'article

Michal Meidan, Is China’s Oil Sector Oblivious to the Country’s 2060 Pledge?, Sep 2021, 71-75.

à lire dans cette issue

voir toute la revue