Renewable Energy: Is China’s Innovation System Adequate to Enable a Low-Carbon Transition?

Anders Hove

Director of the China-Germany Energy Transition Project at GIZIssue

Issue #1Auteurs

Anders Hove

21x29,7cm - 153 pages Issue #1, September 2021

China’s Ecological Power: Analysis, Critiques, and Perspectives

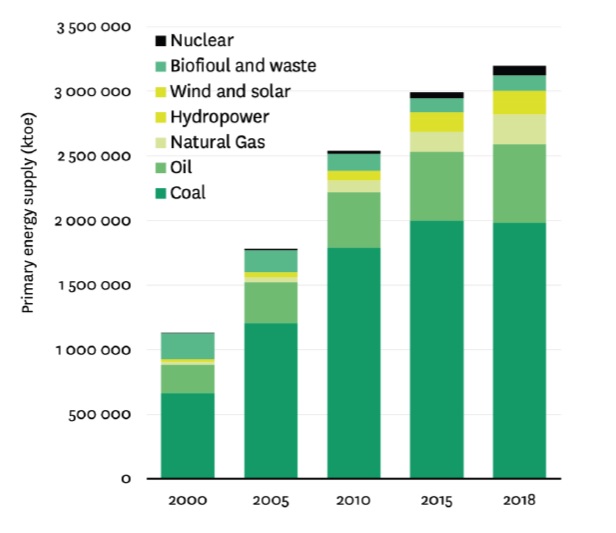

China has made extraordinary progress on renewable energy over the past decade, and in several respects is the world clean energy leader. China leads in terms of total installed capacity of wind, solar, and hydroelectricity, and its manufacturing scale-up of wind, solar, and energy storage have played a central role in making these technologies economically viable worldwide. However, China still obtains the vast majority of its electricity and total primary energy from coal and fossil fuels. Variable wind and solar combined accounted for 9.3% of electricity production in 2020, far lower than in several European countries. (The EU generated 23% of its electricity from wind and solar in 2019, Germany 28%, and Denmark 58%.) However, China’s renewable share has steadily increased. China has supported renewable energy through a suite of policies, beginning with capacity targets, subsidies, and feed-in tariffs and transitioning towards other more complex supports including renewable obligations, priority dispatch, and ultimately market-oriented reforms in the power and emissions trading fields. At present, China’s high-level policy guidance contains a mixture of elements that support continued investment in fossil energy for energy security and long-term guidance promoting a transition to carbon neutrality by 2060, which will entail an immense scaling up of wind and solar, likely at least ten times the present installed capacity of these technologies (Figure 1).

China has surprised observers with its ability to become (in the phrase of Zhang Sufang and Philip Andrews-Speed) a clean energy champion 1 , in terms of institutional changes that have shifted the incentives around utilization of renewable energy as well as efforts to promote innovation. Presently available wind, solar, and energy storage technologies are manufactured and widely commercialized. A review of recent technology announcements as well as scholarly literature suggests that China has developed substantial ability to further innovate in the renewable energy field, particularly in solar and energy storage, though more focused on incremental gains and manufacturing scale-up. At the present state of development of wind, solar, and storage, this may suffice to enable China’s electric power sector to complete a low-carbon energy transition by mid-century.

Figure 1 • Composition of primary energy supply in China

China’s progress in renewables

Renewable capacity

Wind and solar energy capacity in China has increased tenfold in ten years’ time 2 . By the end of 2019, the solar PV and wind installation in China each accounted for 35% of the world’s total. And China’s wind and solar capacity continued to grow apace in 2020. By the end of 2020, the installed capacity of wind reached 282 GW, solar reached 253 GW, and hydro reached 396.63 GW. 3 These figures represent a substantial overachievement of China’s 2020 targets for hydro (340 GW), wind (210 GW), and solar (110 GW) 4 . Since 2010, this represents a compound annual growth rate of 102% for solar, which has grown by a factor of 1150, and a compound annual growth rate for wind of 68.8% for wind, which has grown by a factor of 8.1 5 .

Renewable manufacturing

China’s build-out of clean energy capacity has proceeded in parallel to a huge expansion of its manufacturing base. By the end of 2019, China had silicon wafer production capacity of 173.7 GW, accounting for 94% of the world’s total, according to China Photovoltaic Industry Association 6 . China was also home to 63% of the world’s total cell manufacturing capacity and to 58% of module manufacturing capacity in 2019 7 . China’s wind turbine production accounted for over 40% of world total production by March 2020 8 . (EU manufacturers accounted for around 44% of wind in 2018 9 ). According to Bloomberg New Energy Finance, in early 2019 China had a lithium-ion battery cell manufacturing capacity of 316 GWh, which accounted for 73% of global li-ion battery manufacturing capacity 10 . (The EU share in 2019 was roughly 3% 11 ).

Renewable energy production

In 2019, 27.9% of electricity generated in China came from renewable sources. Total renewable energy production has increased 46.8% since 2010, when it accounted for just 19.0% of electricity generated 12 . The growth rate of renewable energy output has exceeded that of fossil fuel sources in each year since 2015, with renewable output growing at a compound annual rate of 9.6% compared to 5% for fossil sources 13 . According to China’s draft Energy Law, renewable energy should supply the majority of China’s incremental growth in energy demand in the coming decades (no specific official time frame yet) 14 . Coal is still also growing, hence so are the carbon emissions of the electricity sector.

China is in the middle of a major effort to reform its power sector and revolutionize energy production and consumption

China’s renewable energy build-out began in the first decade of the 2000s, but early on energy officials realized that a clean energy transition would depend on institutional and market reforms, particularly in the power sector. Power market reforms began in earnest in early 2015, with the issuance of Document #9 on Deepening Reform in the Power Sector 15 , a document that built on earlier central government decisions to increasingly allow the market to play a decisive role in allocating energy and environmental resources (2014) 16 , and undertaking a revolution in energy consumption, production, and technology (2014) 17 .

Power market reform benefits lower costs to consumers and the expansion of clean energy by ensuring resources with low marginal costs of production—namely wind and solar, which have production costs near zero—take priority in electricity system dispatch. In China, the present sequence of power market reforms began with the publication of an overall framework for reforms in early 2015, and the subsequent 2016 introduction of mid-to-long term bilateral contracts between generators and large industrial customers. These contracts, typically for a month or year in duration, replaced earlier contracts between generators and grid companies that mandated each plant operate for a fixed number of hours at regulated prices 18 . This was followed by reform of transmission and distribution tariffs for both new and existing grids 19 , establishment of new markets for ancillary services 20 , and ultimately ongoing efforts to establish provincial and regional spot power markets 21 .

As of 2021, China’s spot markets remain at an early stage of development: provincial pilots have begun with simulated trading between a limited number of players, and advanced to the level of actual trading between market participants during short periods. Spot market prices published in late 2020 suggest thin trading at prices below the marginal cost of production, indicating that these markets suffer from market inefficiencies and oversupply 22 . However, time-variant prices have also shown a considerable response to changing intra-day supply-demand conditions.

Though functioning and liquid spot markets are likely a precondition to enabling market forces to drive economic dispatch of clean energy, the government has also increasingly required priority dispatch for renewable energy through a combination of administrative targets, requirements, mandates, and incentives 23 . For example, Rule 625 in 2016 required grid companies compensate renewable generators for curtailed energy 24 . As a result of these and other measures, curtailment of wind and solar has fallen to low levels. In 2019, wind curtailment amounted to 4% down from 7% in 2018 and a peak of 17% in 2014 25 . The solar curtailment also fell in 2019 to 2% from the peak of 11% in 2015 26 .

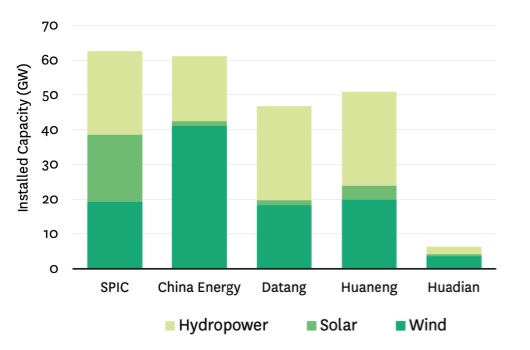

One factor that affects the progress of the clean energy transition in China is that state-owned companies continue to dominate the power sector. In most countries, incumbent utilities—whether state-owned or private—have tended to retain fossil fuel assets while new entrants invest in smaller wind and solar capacity. In China, by contrast, SOEs have led the wind and solar build-out. By the end of 2019, the installation renewable energy capacity of the Big 5 state-owned generation company accounted for almost 30% of China’s total renewable installed capacity—with highest shares of wind and hydro 27 (Figure 2). Many solar plants are owned by SOEs other than the Big 5 28 .

Figure 2 • Installed renewable capacity by big-five generation group by the end of 2019 29

The substantial SOE ownership of power sector assets, including renewable energy assets, means that reforms to institutions and markets that worked in other countries may not produce the same results in China. For example, SOEs facing carbon prices may have different compliance incentives than private firms, but are officially responsible for implementing government directives 30 . In addition, national energy policies are set within a subsystem that comprises state-owned energy think tanks, industry officials, and provincial energy officials 31 . China’s economic and energy planning process place a high value on socioeconomic stability, as reflected in various priorities such as provincial growth and employment numbers, solvency of large state-owned firms and banks, provincial tax revenue and economic transfers, reliable supply of energy, and provincial self-sufficiency.

The long-term transition to clean energy will alter some of these relationships, and may depend on creating new, more long-term market incentives that signal officials, investors, and firms to invest now in renewables and avoid fossil investments. China has adopted several market reforms that have the potential to supplement or replace administrative targets and subsidies for clean energy, but oriented those reforms towards short-term compliance. For example, China’s Renewable Obligation, which requires provinces and grid companies meet certain percentages of renewable consumption, only includes targets 2-3 years out 32 . Similarly, China’s newly-established carbon emissions trading system (ETS) focuses on compliance by large firms in the power sector using emissions benchmarks for coal and other thermal plants, instead of a cap-and-trade or carbon tax 33 . Benchmarks are currently set just a year in advance. Therefore, the RO and carbon ETS provide no market signal that could incentivize future clean energy investment, or disincentive to invest in coal or other fossil infrastructure — except to the extent that market players can anticipate future government decisions on how these mechanisms will evolve over time based on long-term government targets 34 . Hence, targets such as carbon peaking before 2030 and carbon neutrality by 2060, and how local officials implement them, play an outsized role in setting SOE investment decisions and provincial investment approvals.

Although these enabling institutions and markets in China at present appear to offer only modest support for the clean energy transition right now, there is widespread recognition in Europe and the U.S. that the low-carbon transition will require a mix of market and administrative actions, and that market reforms such as spot markets and carbon prices are not a panacea 35 . Arguably, markets have played a peripheral role in growing wind and solar capacity in Europe and North America; rather, renewable portfolio standards, government targets, subsidized R&D, and feed-in tariffs/net metering have played a larger role 36 .

Ultimately, carbon prices and clean energy trading may be most effective only after clean energy has established itself as an economically viable and cost-competitive industry with its own political base of support and proof that countries with high shares of variable wind and solar can function without power cuts or unacceptable price spikes. In other words, in Europe and the U.S., initial policy supports created positive policy feedbacks that ultimately lead to supportive institutions (spot markets that prioritize renewable energy, utility regulators and utility companies that accept consumer-generated electricity, and so on) that continue to support clean energy after support for subsidies fades 37 .

In this context, China has arguably successfully set the stage for such positive policy feedbacks, both through high-level support for a change in energy paradigms and institutions, and through creation of a strong domestic clean energy industry embedded within the existing technoeconomic regime of China’s power sector. If this positive policy feedback continues, provincial officials and SOEs may increasingly see rising returns on investments in clean energy, despite present incentives still favoring investment in long-lasting fossil assets. However, many barriers remain:

- an energy sector paradigm that favors stable electricity generation from centralized power plants owned by powerful SOEs, and stable energy supply from domestic fossil fuels;

- long-standing policy-maker concerns about employment in the coal sector, including in mining and power generation;

- an administrative planning institutional design that could resist allowing the spot market or carbon market to play a larger role in setting energy prices;

- an institutional imperative to prevent financial risks at SOE power companies that own fossil fuel assets, and among provincial governments with financial or economic exposure to fossil fuel industry.

These factors suggest a long period of gradual change in energy mix, even as the economics of renewable energy improves and the case for new fossil fuel investment declines.

Does China have the technology and innovation to reach carbon neutrality?

China needs approximately 10x the wind and solar to reach goals

Growing renewable energy is a central strategy for achieving China’s goals of peaking carbon emissions before 2030 and reaching carbon neutrality by 2060. Various Chinese and international analysts have developed long-term carbon neutrality projections and pathways, all of which place renewable energy at the center.

- An analysis by the Institute of Climate Change and Sustainable Development at Tsinghua University, released in late 2020 shortly after China announced the 2060 climate neutrality goal, projects that non-fossil fuels, including nuclear, would provide 85% of primary energy by 2050, much of this coming from renewable sources 38 . According to Tsinghua University, the vast majority of coal plants will be retired well prior to 2050 and only a small portion will be retrofitted with Carbon capture and storage technology (CCS).

- A 2019 analysis from the China National Renewable Energy Centre projects that under a 2.0°C scenario, China would derive 58% of primary energy from renewables by 2050, which would entail installation of 2600 GW of wind and 2800 GW of solar by that time, a little over 10x year-end capacity in 2020 39 .

- Under the most ambitious projection, a 2020 Lawrence Berkeley National Laboratory study suggested that if current wind and solar cost trends continue, China could reach 62% of energy from renewable sources at a lower cost than under a business-as-usual scenario as early as 2030, which would entail roughly 2,000 GW each of wind and solar capacity 40 .

These targets and projections are undoubtedly ambitious, but are far greater than the growth already experienced in China’s wind and solar sectors over the past decade, which relied heavily on subsidies and supportive policies. In the future, expansion of renewable energy will depend mainly on favorable economics and (as discussed below) market reforms.

Price declines will continue

After accounting for the declining costs of renewable energy, projections of rapid scale-up of wind and solar appear more practical. Worldwide, the International Renewable Energy Agency (IRENA) noted in 2020 that three-quarters of new wind plants and two-fifths of new solar plants cost less than building new fossil fuel plants, and renewables are increasingly competitive with the operating cost of existing fossil plants 41 . In China, where subsidies for new wind and solar projects are gradually being removed, some new wind and solar projects are already cheaper than coal grid tariffs, and the China Solar Industry Association has predicted solar PV could reach parity in 2021 42 . A 2019 analysis of Chinese utility-scale solar PV project costs published in Nature Energy found that unsubsidized PV projects were already cheaper than coal tariffs in most Chinese cities and provinces 43 . A 2021 analysis from the Rocky Mountain Institute also shows that in 2020 the auction prices for new subsidy-free solar projects was at or near the coal tariff in most Chinese provinces, and that 2021 solar auction prices would likely fall below coal tariffs. The analysis also suggested that wind levelized cost of electricity (LCOE) is already below provincial coal tariffs 44 .

The price declines for wind and solar are feeding directly into activity on the ground. Since 2018, China has gradually sought to scale back or eliminate subsidized feed-in tariffs for utility-scale onshore wind and solar PV. China’s present support scheme for wind and PV entails bidding for 20-year power purchase contracts at or below local coal prices. In 2019, China approved 4.5 GW of subsidy-free wind and 14.8 GW of subsidy-free solar PV 45 . The amounts for 2020 (through November) have more than doubled to 11.4 GW of wind and 33 GW of solar 46 .

Achieving cost parity is only part of the picture: which power plant gets built depends on more than just the levelized cost of energy. The variable output of wind and solar generally requires improved flexible operations of dispatchable plants, transmission lines to send renewable energy to a wider geographical area (which reduces variability, particularly for wind), demand that can respond dynamically to short-term changes in energy supply, and potentially energy storage. According to analysis by China’s Energy Research Institute and GIZ, China’s power system is presently less flexible than those in Germany, which hinders uptake of variable renewable sources, though this could be resolved in a relatively short time and needn’t pose an insuperable technical barrier to China’s 2060 carbon neutrality goal 47 . As renewable costs decline, momentum will build towards resolving technical, institutional, policy, and market barriers to the clean energy transition.

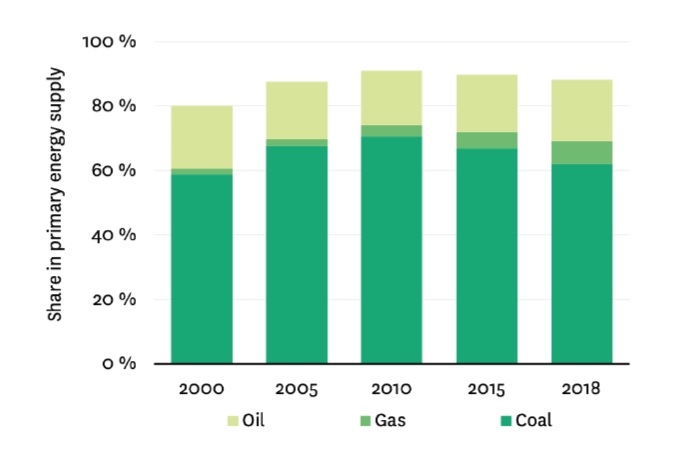

Figure 3 • share of fossil fuels in primary energy supply in china 48

Future RE growth depends on both scale-up and innovation, and China is becoming more innovative—at least in some fields of clean energy

Clean energy journalists and proponents have cited Moore’s Law and Ray Kurzweil’s Law of Accelerating Returns to support the idea that clean energy worldwide could scale up far more rapidly than implied by most conventional energy forecasts 49 . For example, a 2014 article in Greentech Media cited Kurzweil in projecting that solar could dominate electricity production in less than 20 years, and a similar 2013 article from an EV proponent suggested battery electric vehicles could dominate vehicle markets worldwide by 2030 50 . Wind and solar are already at or near price parity on a levelized cost basis, but will price declines continue, and does this depend on China’s innovative capacity?

Economic literature on learning rates and their application to clean energy can provide various answers to this question. First, looking at worldwide cumulative production of wind and solar, there exist a range of estimates of the learning rate—the decline in cost for each doubling of capacity for a given technology—show that wind’s learning rate is roughly 5-10%, solar 20-30%, and battery energy storage 20% 51 . Based on these learning rates, hybrid renewable facilities combining wind, solar, and energy storage would become economical before the mid-2020s 52 .

These numbers mask the many different factors that underlie the cost declines. For example, a 2018 MIT study showed that in the 1990s and 2000s solar PV cost declines were driven by R&D and technology diffusion, whereas in the late 2000s and early 2010s manufacturing scale-up and related knowhow were more important 53 . Today, wind and solar PV have reached the full commercialization stage, while battery energy storage is at the early stage of scale-up.

Anecdotally, Chinese companies and universities regularly announce innovative technologies at both the lab and manufacturing scale. For example:

- 2020 NIO announced solid-state batteries with an energy density of 360 Wh/kg, and plans to install them in vehicles by the end of 2022 54 .

- The 150 MW floating solar power plant in Huainan, Anhui, was the world’s largest floating solar power plant when installed, featuring an innovative floating body and anchoring design. The company also tested the performance of different PV modules on water, including monocrystalline PERC, HIT, bifacial N-type monocrystalline, and stacked sheets 55 .

- In March 2020, Trina Solar began selling ultra-high-power modules over 500 W of power and efficiency over 21%. The products integrated large silicon wafer, non-destructive cutting, and high-density packaging 56 .

- Innovations in wind power center on large-scale, low-velocity blade technology. Sino Wind Energy Group produced the longest 2 MW blades, at 59.5 meters. In terms of blade material, Sinoma Science and Technology invented high-strength silicon-aluminum-magnesium glass fiber, to be used for increasingly larger blades 57 .

China has the necessary infrastructure to support clean energy innovation in the long-term, which should help ensure that clean energy continues to develop and improve. Namely, China has policies to directly support and fund innovation, the country’s energy R&D spending is substantial, the country’s environmental and energy policies are favorable to long-term development and deployment of clean energy, and companies are given clear direction for innovation in clean energy.

China has adopted policies to support and guide clean energy innovation:

- China’s 13th Five-Year Plan for solar development listed various solar technology targets, aiming to increase advanced crystalline silicon PV cell industrialization conversion efficiency to 23%, and develop thin film technology 58 .

- The National Development and Reform Commission in 2016 also set strategic development targets for wind power. The government highlighted four areas for innovation: large-scale wind equipment, offshore system construction, wind farm cluster operation based on big data and cloud computation, and recycling of waste equipment 59 .

- The National Energy Administration established similar targets for energy storage, emphasizing development of storage with renewable energy, microgrids, reduction in cost of storage, and improvement in safety and security of energy storage 60 .

- In October 2020, the State Council outlined several new energy vehicle technologies as key areas for innovation in the next 15 years. These include battery technology, smart network technology, and charging infrastructure improvement 61 .

Overall Chinese R&D spending on clean energy is substantial

China’s spending on energy R&D has risen and accounts for a large amount of the world’s share of government R&D spending. China accounted for around 24% of government energy R&D spending in 2019, according to the IEA, whereas in 2006 China accounted for just 6% of global R&D spending 62 . Government R&D spending in a given field or industry, especially when sustained over long periods, has been shown to correlate with future innovation in related fields 63 . Furthermore, worldwide corporate and venture capital investment into energy R&D has been increasing, and has tended to shift from fossil fuel sectors to more clean energy sectors 64 . In the past, China has benefited from knowledge spillovers from private sector energy R&D due to foreign direct investment in manufacturing as well as through efforts to attract returning scientists and business entrepreneurs 65 . More recently, Chinese overseas investment in clean energy field has the potential to lead to both technology transfer and reverse innovation in China 66 .

Strict environmental regulation and long-term policy support for clean energy also correlate well with clean energy innovation 67 . Over the past decade, renewable energy feed-in tariffs and five-year planning targets have helped scale up the wind and solar sectors. In the future, renewable energy obligations, carbon emissions trading, and provincial targets for carbon peaking are likely to be more important. Such policies both directly influence short-term clean energy investment decisions by energy firms and provincial officials, but help guide decisions about what types of innovative sectors to focus on for longer-term investment.

While China was long thought to be primarily engaged in technology catch-up, and to lack absorptive capacity, this appears not to capture changes over the past decade that result from R&D, stricter environmental targets, and policies that provide long-term support for clean energy. Academic studies have found that China’s innovative capacity in clean energy has now at least partially shifted from the technology catch-up to the fully developed stage. Particularly in the solar and energy storage sectors, China appears to have moved towards the center of the world energy technology innovation system 68 . Whereas a decade ago, Chinese companies filed few solar patents and these were rarely cited outside of the industry, in recent years Chinese solar patents are among the most cited within and outside the industry. A similar change has taken place in energy storage. By contrast, in the field of wind power, where China also leads in annual installations, China’s innovation and patent activity appear focused on more peripheral innovation, and the country remains relatively dependent upon foreign technology 69 . Domestic turbines cost less but offer lower performance than those in the U.S 70 .

Why does China lead in some clean energy technologies but not in all, and what does this portend for the future of clean energy in China? Several factors are at work: First, in terms of the number of patented components, solar and battery technologies appear somewhat simpler, and patent analysis suggests innovation in these fields depends on materials and electronics-related R&D, compared to wind power and other technologies dependent upon both materials and mechanical engineering innovation 71 . The wind power market is dominated by a few major players manufacturing large equipment for multi-MW devices, whereas solar and storage feature commoditized manufacturing and high price competition among producers of relatively smaller cells, packs, and modules. China’s policies in the wind sector encouraged domestic content requirements and localization of manufacturing under a FIT regime that ensured steady revenues, compared to solar where the globally competitive export market and a multiplicity of players forced innovation to keep up with price declines 72 .

The above literature suggests that China already has many of the innovation systems and supportive policies needed to continue to expand renewable energy capacity. But will the field experience the kinds of S-curve adoption in China or worldwide anticipated by some industry boosters? Unlike software, home appliances, or consumer electronics —fields where the S-curve of technology adoption and diffusion has ample recent examples— energy technology is generally capital intensive, durable (expected to last decades or more), and dependent upon complex systems such as power grids, supportive power markets, and resource supply (such as steel for wind turbines, and expensive materials such as silver for PV and cobalt and nickel for batteries).

A 2012 review article listed several systemic variables that determine the speed of clean energy technology adoption or diffusion 73 as shown in Figure 4.

Figure 4 • Brief evaluation of potential barriers affecting diffusion of renewable energy in China

Among the factors listed above, China appears to have overcome some of the major systemic barriers. As noted above, China appears to possess adequate innovation infrastructure, stable and rising policy-driven demand for clean energy, an ample clean energy work force, and positive policy feedbacks from a now well-established clean energy industry and supportive policy environment. In terms of technical policy and market knowhow, and overall energy sector paradigms, China has many experts and industry leaders advocating for an overall paradigm shift, as embodied and adopted by the central government in the form of policies supporting an overall revolution in energy consumption and production, with the ultimate aim of carbon neutrality by 2060. However, the incumbent power sector paradigm remains strong, featuring centralized generation from large coal and hydro plants, dominated by large, state-owned generation companies and grid companies, and oriented around energy security through ample baseload power.

Conclusion

Though the country’s energy system remains reliant on fossil energy sources, China’s renewable energy transition is well underway, as shown by rising capacity of clean energy sources as well as gradually rising shares of clean energy production. Institutional reforms are underway as well, including spot markets and carbon trading, though both are at an earlier stage. The country’s innovation system has grown and deepened, enabling China to move on from an earlier period of technology catch up. Given the already favorable economics and present learning rates for wind, solar, and storage, these technologies are likely to continue to grow steadily, making possible a successful low-carbon energy transition within China’s power sector.

Notes

- P. Andrews-Speed et S. Zhang, China as a Global Clean Energy Champion: Lifting the Veil, Palgrave Series in Asia and Pacific Studies, 2019.

- Emiliano Bellini, “ World now has 583.5 GW of operational PV ”, PV-magazine, avril 2020 ; “ International Renewable Energy Agency Database ”, International Renewable Energy Agency, consulted on January 13 2021.

- “ 2020年全社会用电量同比增长3.1 % ” ,National Energy Administration, janvier 2021 ; “ 2019年电力工业统计基本数据一览表 ”, China Electricity Council, June 2020.

- “ 国家发展改革委 国家能源局关于印发能源发展“十三五”规划的通知 ” National Development and Reform Commission, January 2017.

- “ 2010年电力工业统计基本数据一览表 ”, China Electricity Council, April 2013.

- Reuters Staff, “China to restrict expansion of solar equipment producers”, Reuters, May 2020.

- T. Andre et al., “Renewables 2020 Global Status Report”, REN21, 2020.

- B. Chen, “China’s wind turbine manufacturing ecosystem and its potential” Mirae Asset, 2020.

- “Vestas takes global OEM lead in 2018 – GWEC”, Global Wind Energy Council, April 2019.

- R. Rapier, “Why China Is Dominating Lithium-Ion Battery Production”, August 2019.

- I. Tsiropoulos et al., “Li-ion batteries for mobility and stationary storage applications”, Joint Research Centre, European Commission, 2019.

- “国家能源局2020年一季度网上新闻发布会文字实录”, National Energy Administration, March 2020 ; “国家能源局:2010年能源经济形势及2011年展望”, National Energy Administration, January 2011 ; “国家能源局关于2015年度全国可再生能源电力发展监测评价的通报, 国能新能[2016]214号”, National Energy Administration, August 2016.

- “2019年电力工业统计基本数据一览表”, China Electricity Council, June 2020.

- “国家能源局关于《中华人民共和国能源法(征求意见稿)》公开征求意见的公告”, National Energy Administration, April 2020.

- “Opinions on Deepening Reform of the Electricity System, Central Committee No. 9”, Central Committee of the Communist Party of China and State Council, March 2015.

- “习近平:正确发挥市场作用和政府作用 推动经济社会持续健康发展”, Xinhua News Agency, May 2014.

- “习近平:积极推动我国能源生产和消费革命”, Xinhua News Agency, June 2014.

- “电力中长期交易基本规则(暂行), 发改能源 (2016) 2784号”, National Development and Reform Commission and National Energy Administration, 29 December 2016.

- “ 国家发展改革委关于印发《区域电网输电价格定价办法》的通知, 发改价格规〔2020〕100号 ”, National Development and Reform Commission, January 2020 ; “ 展改革委关于印发《省级电网输配电价定价办法》的通知, 发改价格规〔2020〕101号 ”, National Development and Reform Commission, January 2020.

- “ 完善电力辅助服务补偿(市场)机制工作方案, 国能发监管〔2017〕67号 ”, National Energy Administration, November 2017.

- “ 国家发展改革委办公厅 国家能源局综合司印发《关于深化电力现货市场建设试点工作的意见》的通知, 发改办能源规〔2019〕828号 ”, National Development and Reform Commission and National Energy Administration, August 2019.

- L. Shan, et. al., “ 电力现货还能走多? ”, China Energy News, January 2021.

- “ 国家发展改革委 国家能源局关于规范优先发电优先购电计划管理的通知, 发改运行〔2019〕144号 ”, National Development and Reform Commission and National Energy Administration, January 2019.

- “可再生能源发电全额保障性收购管理办法, 发改能源〔2016〕625号 [Renewable Electricity Full Purchase Guarantee Management Act, NDRC (2016) No. 625],” National Development and Reform Commission Number 625, 24 March 2016.

- “2019年风电并网运行情况,” National Energy Agency, 28 February 2020.

- Ibid.

- S. Sang, “ 大幅提升光伏规模!国家能源集团计划未来5年新增25-30GW装机 ”, Beijixing, October 2020.

- “ 36家企业持有全国42%的光伏电站 民企为光伏电站投资中坚力量 ”, Century New Energy Network, mars 2019.

- Sources : Beijixing, 2020.

- P. Benoit et A. Clark, “Making State-Owned Enterprises Work for Climate in China and Beyond”, Columbia Center on Global Energy Policy, September 2020.

- P. Andrews-Speed, Z. Sufang, China as a Global Clean Energy Champion, Palgrave Macmillan, 2019.

- “ 国家发展改革委 国家能源局关于建立健全可再生能源电力消纳保障机制的通知, 发改能源〔2019〕807号 ”, National Development and Reform Commission and National Energy Administration, May 2019.

- “ 碳排放权交易管理办法(试行), 生态环境部令, 第19号 ”, Ministry of Ecology and Environment, December 2020 ; “ 关于印发《2019-2020年全国碳排放权交易配额总量设定与分配实施方案(发电行业)》《纳入2019-2020年全国碳排放权交易配额管理的重点排放单位名单》并做好发电行业配额预分配工作的通知, 国环规气候〔2020〕3号 ”, Ministry of Ecology and Environment, December 2020.

- A. Hove, “ Trends and Contradictions in China’s Renewable Energy Policy ”, Columbia University, Center on Global Energy Policy, août 2020.

- J. D. Jenkins, “Political economy constraints on carbon pricing policies: What are the implications for economic efficiency, environmental efficacy, and climate policy design?” Energy Policy, 2014 ; D. Rosenbloom et al., “Opinion: Why carbon pricing is not sufficient to mitigate climate change — and how ‘sustainability transition policy’ can help”, Proceedings of the National Academy of Sciences of the United States of America, avril 2020.

- F. W. Geels et al., “Sociotechnical transitions for deep decarbonization”, septembre 2017.

- L. C. Stokes, “Short Circuiting Policy: Interest Groups and the Battle Over Clean Energy and Climate Policy in the American States”, Oxford University Press, 2020.

- H. Jiankun, “Launch of the Outcome of the Research on China’s Long-term Low-carbon Development Strategy and Pathway”, Tsinghua University, Institute of Climate Change and Sustainable Development, October 2020.

- “China Renewable Energy Outlook 2019: Executive Summary”, Centre national chinois des énergies renouvelables, Institut de recherche sur l’énergie de la Commission nationale du développement et de la réforme, 2020.

- G. He et al., “Rapid cost decrease of renewable energy and storage offers an opportunity to accelerate the decarbonization of China’s power system”, Division de l’analyse énergétique et des incidences environnementales, Lawrence Berkeley National Laboratory, March 2020.

- “Renewable Power Generation Costs in 2019”, Agence internationale pour les énergies renouvelables (IRENA), juin 2020.

- Y. Yu, “China’s Solar Market: Renewable Investors’ Critical Battlefield” Energy Iceberg, octobre 2020.

- J. Yan et al., “City-level analysis of subsidy-free solar photovoltaic electricity price, profits and grid parity in China”, Nature Energy 4, août 2019.

- Y. Cao et al., “China Zero-Carbon Electricity Growth in the 2020s: A Vital Step Towards Carbon Neutrality”, Rocky Mountain Institute, à paraître en 2021.

- “ 国家发展改革委办公厅 国家能源局综合司关于公布2019年第一批风电、光伏发电平价上网项目的通知 ”, Nation Energy Administration, May 2019.

- “ 国家发展改革委办公厅 国家能源局综合司关于公布2020年风电、光伏发电平价上网项目的通知 ”, National Development and Reform Commission, July 2020.

- Z. Yanan et al., “A Quantitative Comparative Study of Power System Flexibility in Jing-Jin-Ji and Germany”, National Development and Reform Commission, Energy Research Institute, December 2020.

- Sources : IEA, 2020.

- R. Kurzweil, “The Law of Accelerating Returns”, Kurzeweil Accelerating Intelligence, March 2001.

- T. Hunt, “Are We Halfway to Market Dominance for Solar?”, Greentech Media, avril 2014 ; Z. Shahan, “Electric Cars May Be About 50% On Their Way To Market Domination”, EV Obsession, December 2013.

- J. Grafström, and Å. Lindman, “Invention, Innovation and Diffusion in the European Wind Power Sector”, Technological Forecasting and Social Change, 2016 ; “Clean Energy Innovation”, Agence internationale de l’énergie, 2020 ; X. N. Penisa et al., “Projecting the Price of Lithium-Ion NMC Battery Packs Using a Multifactor Learning Curve Model”, Energies, September 2020.

- X. N. Penisa et al., op.cit.

- G. Kavlak et al., “Evaluating the causes of cost reduction in photovoltaic modules”, Energy Policy 123, December 2018.

- “蔚来发布的“固态电池”到底是个啥”, Financial World, January 2020.

- “三峡淮南水面漂浮式光伏电站:打造水面光伏技术创新新样本”, State-owned Assets Supervision and Administration Commission of the State Council, January 2019.

- “光伏企业发力技术创新 迎平价时代挑战”, Xinhua Finance, March 2020.

- “大型风电叶片设计制造技术发展趋势”, China Science, December 2016.

- “国家能源局关于印发《太阳能发展“十三五”规划》的通知”, National Energy Administration, December 2016.

- “中国大型风电技术创新路线图2016-2030”, Beijixing Wind Power, June 2016.

- “国家发展改革委 国家能源局关于印发能源发展“十三五”规划的通知”,National Energy Administration, January 2017.

- “国务院办公厅关于印发新能源汽车产业发展规划(2021—2035年)的通知”, State Council Office, October 2020.

- World Energy Investment in 2020: R&D and technology innovation”, International Energy Agency, May 2020.

- J. Grafstrom, “Modern era Knowledge Spillovers in the Solar energy sector”, Luleå University of Technology Economics, USAEE Working Paper, March 2019.

- “World Energy Investment in 2020: R&D and technology innovation”,National Energy Agency, May 2020.

- L. Weiwei et al., “Impacts of FDI Renewable Energy Technology Spillover on China’s Energy Industry Performance”, Sustainability 8(9), August 2016 ; F. Xiaolan, “Foreign Direct Investment, Absorptive Capacity and Regional Innovation Capabilities: Evidence from China”, Global Forum on International Investment, Organization of Economic Cooperation and Development, March 2008 ; L. Siping et al., “Intellectual Returnees as Drivers of Indigenous Innovation: Evidence from the Chinese Photovoltaic Industry”, National Bureau of Economic Research, October 2013.

- Y. Bai et al., “Can environmental innovation benefit from outward foreign direct investment to developed countries? Evidence from Chinese manufacturing enterprises”, Environmental Science and Pollution Research, November 2020.

- J. Olson Lanjouw and A. Mody, “Innovation and the international diffusion of environmentally responsive technology”, Research Policy 25(4), 1996.

- Y. Wang et al, “Comparing the Technology Trajectories of Solar PV and Solar Water Heaters in China: Using a Patent Lens”, Sustainability, 2018.

- Y. Zhou et al, “Comparing the International Knowledge Flow of China’s Wind and Solar Photovoltaic (PV) Industries: Patent Analysis and Implications for Sustainable Development”, Sustainability, 2018.

- X. Lu et al., “Challenges faced by China compared with the US in developing wind power”, Nature Energy 1, mai 2016.

- G. F. Nemet, “Inter-Technology Knowledge Spillovers for Energy Technologies”, Energy Economics 34(5), 2012. ; J. Noailly et V. Shestalova, “Knowledge spillovers from renewable energy technologies: Lessons from patent citations”, Graduate Institute Geneva, Centre for International Environmental Studies, 2013.

- Z. Yuan et al, “Comparing the International Knowledge Flow of China’s Wind and Solar Photovoltaic (PV) Industries: Patent Analysis and Implications for Sustainable Development”, Sustainability, 2018.

- S. O. Negro et al, “Why does renewable energy diffuse so slowly? A review of innovation system problems”, Renewable & Sustainable Energy Reviews, 2012.

citer l'article

Anders Hove, Renewable Energy: Is China’s Innovation System Adequate to Enable a Low-Carbon Transition?, Sep 2021, 76-85.

à lire dans cette issue

voir toute la revue