Africa has the most to gain from clean energy transitions

Fatih Birol

Executive Director, International Energy Agency Télécharger le pdf

29/06/2022

Africa has the most to gain from clean energy transitions

Fatih Birol

Executive Director, International Energy Agency

29/06/2022

Voir tous les articles

Voir tous les articles

Africa has the most to gain from clean energy transitions

This article is also available in Spanish on el Grand Continent.

Nowhere are the impacts of today’s high energy and food prices more destructive than in Africa, where they are least able to afford these increases.

Russia’s invasion of Ukraine – beyond the human tragedies that Ukrainians are enduring – has disrupted global supply chains, sent food, energy and other commodity prices soaring, and increased the strains on African economies already hard hit by the Covid-19 pandemic. The number of people affected by food crises has already quadrupled in some parts of Africa, drawing further upon Africans limited income. Even before Russia’s war, the number of Africans who do not have access to electricity was on the rise once again due to waning affordability, reversing years of steady progress since 2013. Those without access to clean cooking continued to grow through the pandemic, and now liquefied petroleum gas—one of the key clean cooking fuels available in Africa today—has become increasingly expensive, more than 30 million people could lose the ability to afford clean cooking solutions by the end of 2022. In efforts to keep electricity and fuels affordable African governments, utilities, and companies face severe financial difficulties, increasing risks of blackouts and rationing.

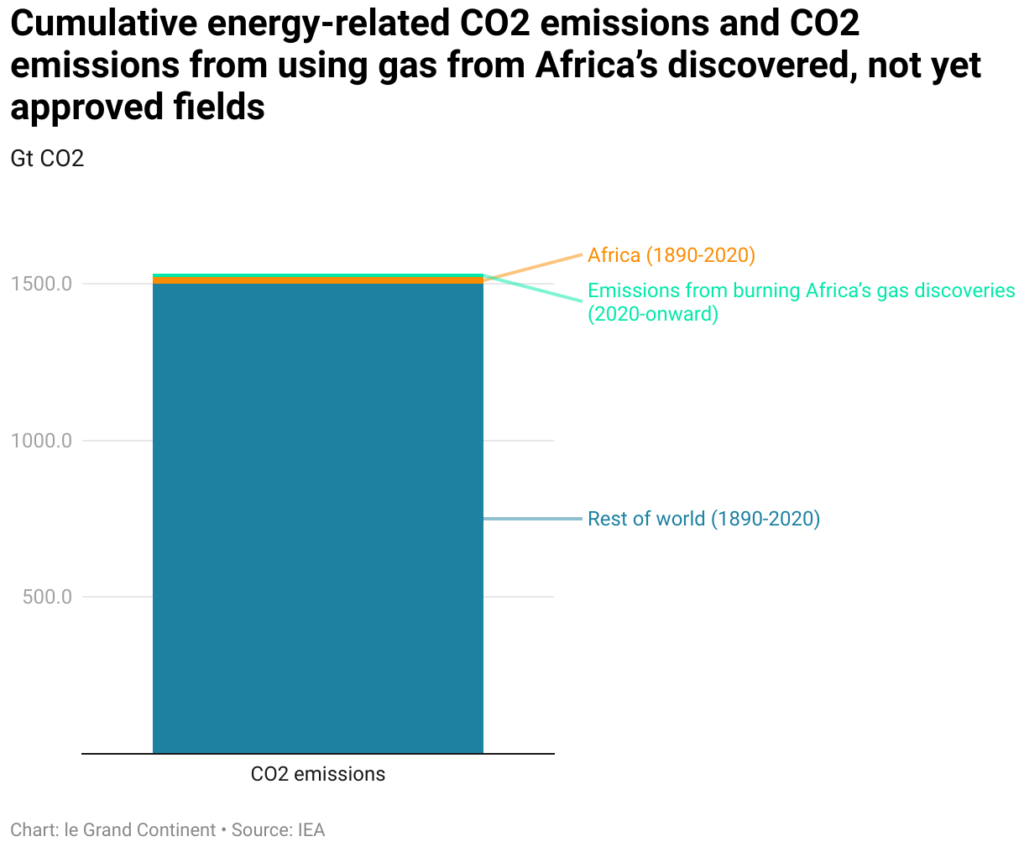

It is one of the world’s great injustices that Africa is perhaps the region of the planet most exposed to climate disruptions – ranging from severe droughts to destructive flooding — even though its people have contributed the least to the energy-related greenhouse gas emissions than the inhabitants of any other continent. African’s have contributed less than 3% of cumulative global CO2 emissions since the start of the industrial revolution.

Yet for all of these challenges, the message from the International Energy Agency’s Africa Energy Outlook 2022 is that the global clean energy transition holds great promise for the continent’s economic and social development. The global ambition to reach net zero greenhouse emissions, laid out in our landmark Net Zero by 2050 (NZE) report last year, is setting a new course for the global energy sector, leading to declining clean technology costs and shifting global investment patterns. African countries are poised to capture the technology spill-overs of these changes and attract increasing flows of climate finance.

Within Africa itself, the transition poses many opportunities. Solar-based access solutions have become one of the fastest growing access solutions for those in rural areas. Solar-powered irrigation pumps are less expensive than diesel-powered pumps, and can enhance African food productivity and drought resilience. Assembling these access solutions and manufacturing key components is a growing segment for African industry. However this will be far surpassed by the growing opportunities for Africa to emerge as a major player in the mining and processing of critical minerals, which are essential to build the batteries, hydrogen technologies and renewables of the future. We also see promising new green hydrogen development underway in Africa, another field with huge potential for the continent.

We at the IEA have been working on African energy issues for more than two decades, and now proudly count three African countries among our IEA Associate countries. This Outlook –which is under the banner of our flagship World Energy Outlook series — was written in cooperation with the African Union Commission and the United Nations Economic Commission for Africa, along with over 20 African contributing experts. It explores a Sustainable Africa Scenario (SAS) in which Africa navigates the shifting tides of the current global turmoil to then ride the momentum of global clean energy transitions to achieve all African energy-related development goals on time and in full. These includes universal access to modern energy services by 2030 and the full implementation of all African climate pledges. Realising all of these goals will be a formidable undertaking. African countries need to be in the driver’s seat, setting the course for where international institutions must reinforce their efforts on the ground to significantly increase needed investments in Africa’s energy development.

Achieving universal access to affordable energy for all Africans remains the absolute and immediate priority. By the end of 2021, 600 million Africans lack access to electricity, which is 43% of the total population and 4% more people than in 2019. These figures have no parallel in any other region of the world, where either near-full access has been achieved, or as is the case in much of Asia, connection campaigns continued even during the Covid-19 pandemic, thanks to strong policy support. Most of Africa’s un-connected population live in sub-Saharan Africa and 80% live in rural areas. At the same time, 970 million Africans lack access to clean cooking fuels, with terrible health consequences for people (especially women and children) and hinders social and economic advancement of those lacking clean cooking sources, and has marked impacts for the environment (GHG emissions and deforestation).

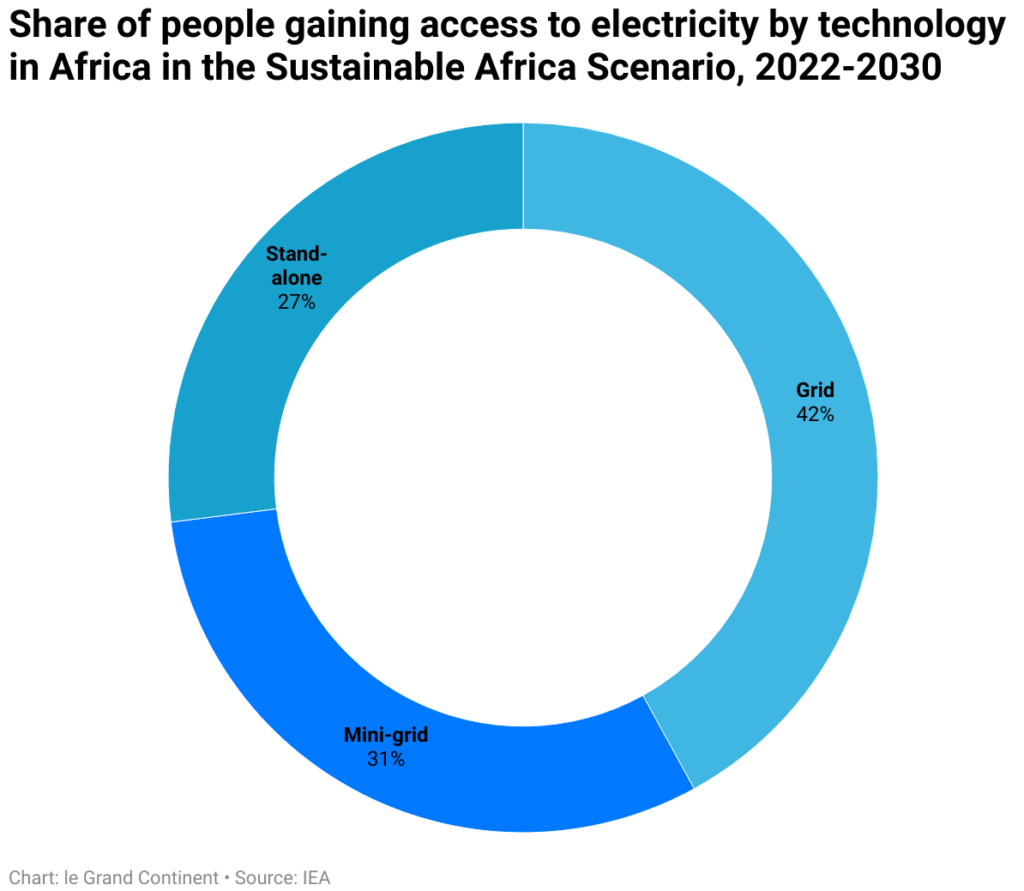

Universal access to affordable electricity in Africa, achieved by 2030 in the SAS, requires connecting 90 million people a year—triple the rate of recent years. Countries such as Ghana, Kenya and Rwanda are on track for full access by 2030, offering success stories other countries can follow. Solutions need to be correctly targeted. Our detailed analysis shows that extending national grids is the most suitable option for 45% of those gaining access to 2030, mostly those living in more heavily populated areas. In rural areas, mini-grids and stand-alone systems, mostly solar based, are often the most viable solutions. Many of the households that gain first‐time access through mini‐grids and stand‐alone systems are eventually connected to a grid, with off‐grid systems, especially mini‐grids, becoming integrated into it so as to improve the overall reliability of the electricity network. Only the most remote settlements still lack a grid connection in 2050.

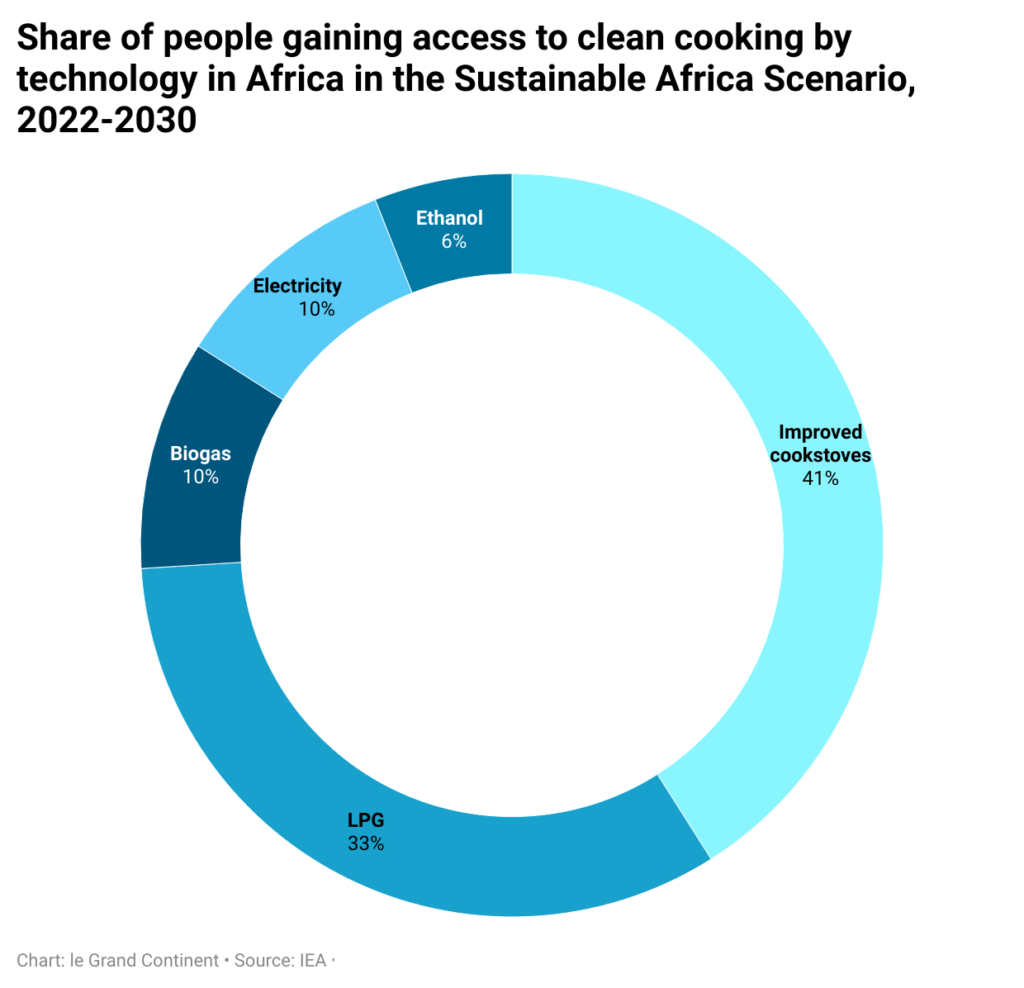

For clean cooking fuels and technologies, achieving universal access by 2030 requires shifting 130 million people away from dirty cooking fuels each year. Liquefied petroleum gas (LPG) is the leading solution in urban areas, but recent price spikes are making it unaffordable for 30 million people across Africa, pushing many to revert to the traditional use of biomass. Countries are re-evaluating clean fuel subsidy schemes and exploring alternatives such as improved biomass cook stoves, electric cooking and biodigesters. The rate of progress needed for universal clean cooking access by 2030 are unprecedented, but the benefits are huge: reducing premature deaths from air pollution by about 500 000 a year by 2030, drastically cutting time spent gathering fuel and cooking, and allowing millions of women to pursue education, employment and civic involvement.

The goal of universal access to modern energy would require investing USD 25 billion per year. This may sound like a lot, but it is less than 1% of global energy investment today, and similar to the cost of planning and constructing just one large LNG terminal. Stimulating the needed investment certainly requires strong international support. But there’s also a need for national institutions to lay out clear access strategies, something only around 25 African countries have done today.

Demand for energy services in Africa is set to grow rapidly and maintaining affordability remains an urgent priority. As Africa’s population and incomes grow, our Sustainable Africa Scenarios sees demand for modern energy expanding by a third between 2020 and 2030. However, many African countries subsidise energy use and under existing subsidy schemes, today’s price spikes risk doubling energy subsidy burdens in African countries in 2022. This is an untenable situation for many countries already facing heavy debt burdens. Growing financial burdens are pushing some countries, including Egypt, Ethiopia and Uganda, to halt or reduce subsidies, or to reinstate fuel taxes. International support must play a role in the near term to manage prices, but it is essential that subsidies are better targeted to focus on the households most in need.

As is the case everywhere, as demand for energy grows in Africa, it will become increasingly important to use it more efficiently. The SAS prioritises helping Africans climb the energy ladder, as today Africa has the world’s lowest levels of per capita use of modern energy. However efficiency is essential for maintaining affordability and enabling these growing levels of consumptions. Efficiency policies targeting the sale of only the most inefficient appliances and vehicles can drastically reduce fuel import bills, ease strain on existing infrastructure, and helps address dumping of broken, unrepairable appliances and vehicles onto African shores. With the right targeting this can be done without drastically increasing the upfront cost of needed appliances and energy services. In the SAS scenario, energy and material efficiency reduces electricity demand by 230 terawatt-hours (TWh) in 2030, or an amount equal to 30% of Africa’s electricity demand today. Common-sense building codes and energy performance standards, which restrict the sale of the least-efficient household appliances and lighting, make up 60% of these savings. Energy demand for fans and air conditioning still quadruples over the decade as urbanisation and climate change rapidly increase the need for cooling in Africa, requiring greater efforts to make cooling systems more efficient.

Africa’s energy demand is not driven just by population expansion, but also by growing industrial, commercial and agricultural activity. In the SAS, African energy demand in industry, freight and agriculture grows by almost 40% by 2030. Increased production of fertilisers, steel and cement, as well as manufacturing of appliances, vehicles and clean energy technologies, helps to reduce Africa dependency on imports, which represent more than 20% of GDP today. Some industrial sectors adopt the latest, most efficient technologies. In agriculture, which represents one-fifth of Africa’s GDP, irrigation pumps are electrified, reducing diesel generator use, and refrigerated supply chains are extended, boosting agricultural productivity and the scope for farmers’ products to reach urban markets.

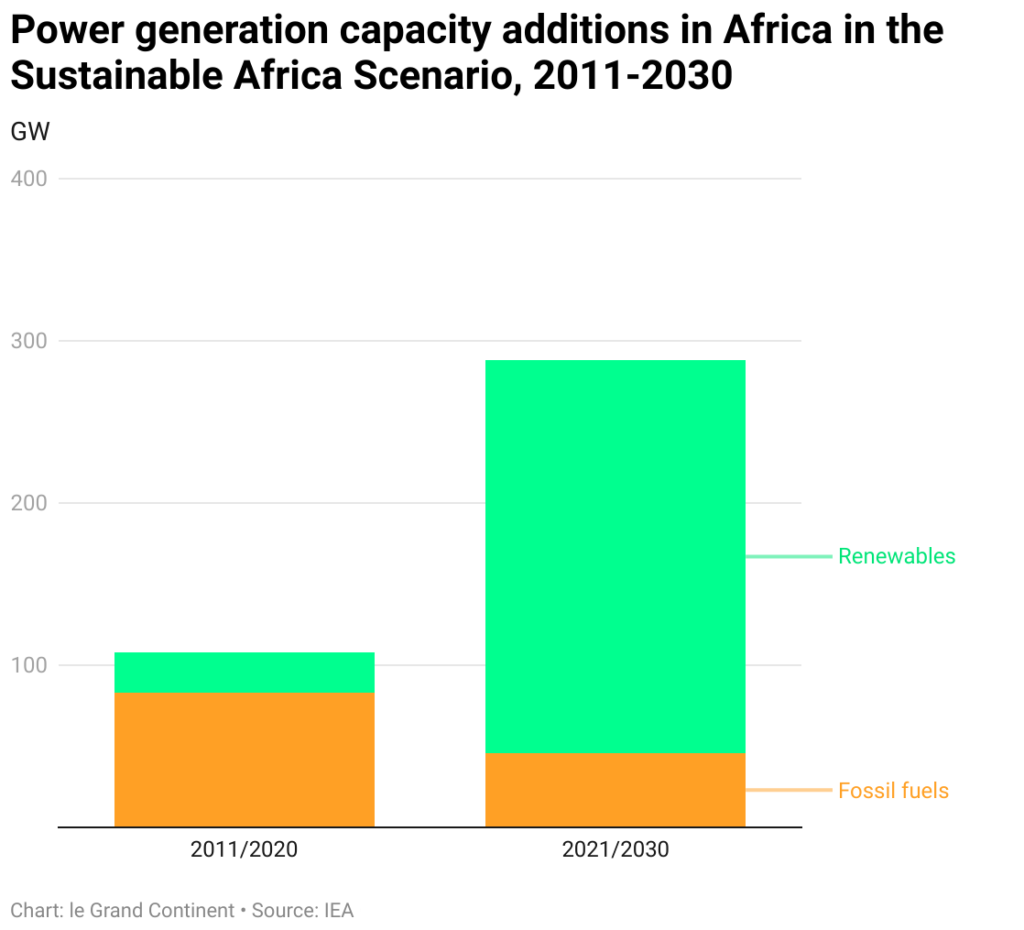

Electricity will be the backbone of Africa’s new energy systems, and increasingly it will be generated by renewables, with solar leading the way. Africa is home to 60% of the best solar resources globally, yet the continent hosts only 1% of installed solar PV capacity—less than the Netherlands. Solar PV is already the cheapest source of power in many parts of Africa, but it will be the most competitive source throughout the continent by 2030. Renewables – including solar, wind, hydropower and geothermal – will account for over 80% of new power generation capacity installed to 2030 in the SAS. Coal-fired power plants currently under construction will be completed, but after that Africa builds no new ones in our scenario, largely as a result of China’s announcement that it will end support for coal plants abroad. If the investment initially intended for these discontinued coal plants were redirected to solar PV, it could cover half of the cost of all Africa’s solar PV capacity additions to 2025 in the SAS.

Flexibility is key to integrating more variable renewables, because, after all, the sun does not always shine and the wind does not always blow. Grid interconnection, hydropower and natural gas plants will play notable roles in integrating renewables and providing dispatchable power. Regional power pools are needed to improve reliability of supply – a major problem in Africa which gives many household users pause when considering further electrification of their daily energy needs and shapes industry decision-making when choosing where to site their new facilities. Expanding and modernising Africa’s grids and other electricity infrastructure will require a radical improvement in the financial health of public utilities, which have been battered by Covid-19 lockdowns, other recent economic crises and longstanding under-pricing of electricity. Regulatory reforms are a priority, particularly those to make electricity consumer prices better reflect the cost of service. Such reforms are in place or under discussion in 24 African countries to date.

Electricity will eventually dominate Africa’s energy systems, but oil and gas will still be crucial to meet Africa’s demand this decade. Africa’s industrialisation, in particular, relies in part on expanding natural gas use. Natural gas demand in Africa increases in the SAS, but gas maintains the same share of modern energy use as today, with electricity generation from renewables outcompeting it in most cases. More than 5 000 billion cubic metres (bcm) of natural gas has been discovered to date in Africa but not yet been approved for development. These resources could be providing markets with an additional 90 bcm of gas a year by 2030, which may well be vital for the fertiliser industry, steel manufacturing, cement production and water desalination. Cumulative CO2 emissions from the use of these gas resources over the next 30 years would be around 10 gigatonnes. If these emissions were added to Africa’s cumulative total today, they would still only bring its share of global emissions to a mere 3.5%.

Production of oil and gas remains important to African economic and social development, especially as the industry’s focus will shift from export markets to meeting domestic demand. Global efforts to accelerate the clean energy transition threatens Africa’s oil and gas producers with dwindling export revenues. But between now and 2030, Africa’s domestic demand for both oil and gas accounts for around two-thirds of the continent’s production, with the share of domestic consumption in 2030 reaching nearly 20 percentage points higher than it was in 2010. This puts greater emphasis on developing well-functioning infrastructure within Africa, such as storage and distribution infrastructure, to meet domestic demand for transport fuels and LPG.

Current price surges are providing a short-term boon to African producers, with new deals signed to deliver Algerian gas to Europe, along with renewed momentum to develop and expand LNG terminals in Congo, Mauritania, and Senegal. With the European Union aiming to halt Russian gas imports towards 2030, Africa in principle could supply an extra 30 bcm in 2030. Reducing flaring and venting could quickly make 10 bcm of African gas available for export without the development of new supply and transport infrastructure. But these near-term market opportunities should not distract policy makers from the near certainty that oil and gas export revenues will decline in the future. New projects benefit from speed to market, minimising project costs and delays, and reducing methane emissions. But gas projects with long-lead-times risk failing to recover their upfront costs if the world is successful in bringing down gas demand in line with reaching net zero emissions by mid-century.

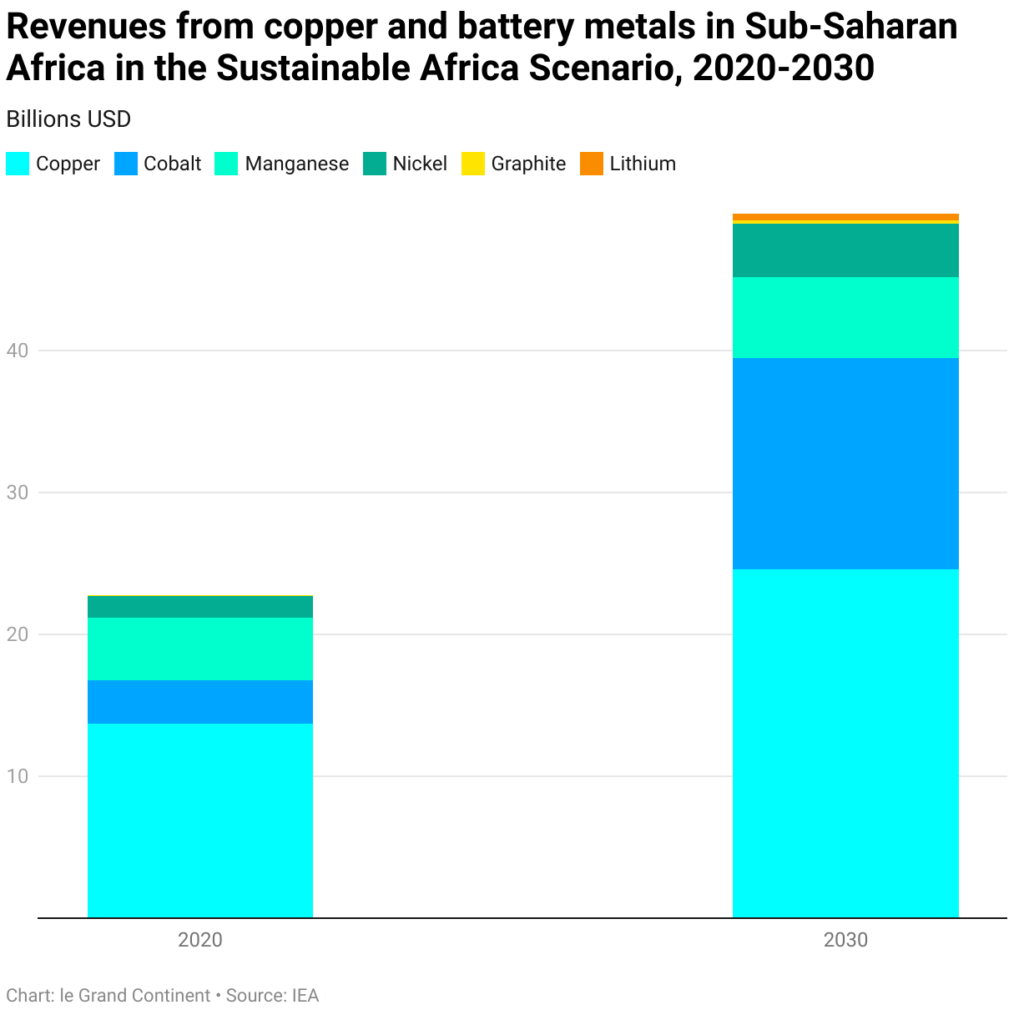

While export revenue from oil and gas risks decreasing in the long-term, Africa’s vast resources of minerals that are critical for multiple clean energy technologies are set to create new market opportunities for the continent. Africa accounts for over 40% of global reserves of cobalt, manganese and platinum, all essential minerals for batteries and hydrogen technologies. South Africa, the Democratic Republic of Congo, Gabon and Mozambique having a significant share of global production today, but many other countries may hold undiscovered deposits. In the SAS, Africa’s revenues from critical mineral exports more than double by 2030.

However, these resources need to be well managed to avoid unwanted externalities and to guarantee that the benefits accrue to African populations. Investment in mineral exploration in Africa has been declining in recent years, and reversing this trend hinges on improved geological surveys, robust governance, improved transport infrastructure and a particularly strong focus on minimising the environmental and social impacts of mining operations.

Beyond critical minerals, Africa has huge potential to produce hydrogen using its rich renewable resources. A number of low-carbon hydrogen projects are underway or under discussion in Egypt, Mauritania, Morocco, Namibia and South Africa. These are focused primarily on using renewable power to produce ammonia for fertilisers, which would strengthen Africa’s food security. But global declines in the cost of hydrogen production could allow Africa to deliver renewable-produced hydrogen to Northern Europe at internationally competitive price points by 2030. With further cost declines, Africa would have the potential to produce 5 000 megatonnes per year of hydrogen at less than USD 2 per kilogramme. This is 10 times the amount of low-carbon hydrogen needed globally in 2050 in the IEA’s Net Zero Emissions by 2050 Scenario.

Africa’s energy transformation can only succeed if it has the support of the general population and brings them benefits. People must be at the centre of Africa’s energy transition. Developing home-grown energy industries can reduce imports, create jobs and build a local capital base. In the SAS, almost 4 million additional energy-related jobs are needed across the continent by 2030, largely to reach universal energy access in sub-Saharan Africa. Many of the jobs offer entry into the formal economy, with increase entrepreneurial opportunities for women. African energy companies play an increasing role in our scenario, with joint ventures and technology transfer helping develop local know-how. Implementing an African Continental Free Trade Area would also help broaden domestic markets for African energy firms.

Africa has much to gain from global efforts to tackle harmful greenhouse gas emissions because it is already facing more severe climate change than most other parts of the world, despite bearing the least responsibility for the problem. With nearly one-fifth of the world’s population today, Africa accounts for less than 3% of the world’s energy-related CO2 emissions to date and has the lowest emissions per capita of any region. Yet Africans are already suffering disproportionately from the negative effects of climate change, including water stress, reduced food production, increased frequency of extreme weather events, and lower economic growth – all of which are fuelling mass migration and regional instability.

As of May 2022, countries representing more than 70% of global CO2 emissions have committed to reach net zero emissions by around mid-century. This includes 12 African countries that represent over 40% of the continent’s total emissions. Africa will remain a minor contributor to global emissions, yet it needs to do far more to adapt to climate risks than the rest of the world. Regardless of the chosen scenario, by 2050 Africa accounts for no more than 4% of cumulative global energy-related CO2 emissions. Yet with today’s policy settings, the global average temperature rise is likely to hit 2 °C around 2050, but this would probably result in mean temperatures being 2.7 °C higher in North Africa. Temperature rise globally of 2 °C would reduce African GDP by around 8% in 2050 compared with a baseline without any climate impacts. Losses in some regions such as East Africa, currently undergoing a devastating drought, would reach around 15%.

Urgent action to adapt to climate change would reduce the severity of these economic effects but require much more investment. Funding for climate adaptation could reach USD 30-50 billion per year by 2030 – a huge increase on the USD 7.8 billion that was provided by advanced economies for adaptation projects in 2019. Some of this will be needed to make Africa’s energy systems more resilient against climate risks. For example, three-fifths of Africa’s thermal power plants are at high or very high risk of being disrupted by water shortages, and one-sixth of Africa’s LNG capacity is vulnerable to coastal flooding.

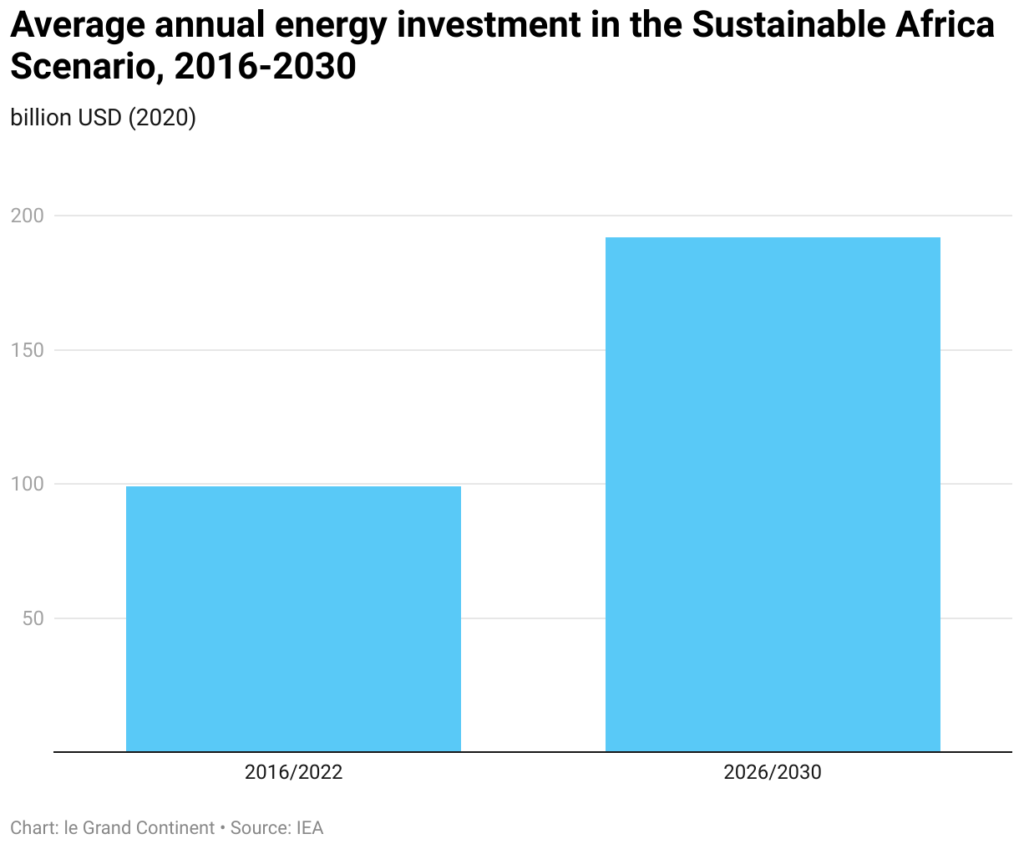

Achieving Africa’s energy and climate goals means more than doubling energy investment this decade, which would take it over USD 190 billion each year from 2026 to 2030, with two thirds going to clean energy. The share of energy investment in Africa’s GDP rises to 6.1% in 2026-30 in the SAS, slightly above the average for emerging and developing economies. But Africa’s energy investment in that period is still only around 5% of the global total in the NZE Scenario.

Multilateral development banks must make financing Africa’s transition an absolute priority. To mobilise the amount of investment envisioned in the SAS, they will need to increase concessional finance to Africa and use it more strategically to better leverage private capital. Domestic financial markets would need to more than double in size by the second half of this decade. New capital sources, such as climate finance and carbon credits, can attract more international financial flows. However, cross-cutting investment risks such as high debt burdens remain a challenge.

The continent’s energy future requires stronger efforts on the ground, backed by global support. The COP27 Climate Change Conference in Egypt in late 2022 provides a crucial platform for African leaders to work globally to identify ways to drive these changes. This decade is critical, not only for global climate action, but also to accelerate the investments that will allow Africa – home to the world’s youngest population – to flourish in the decades to come.

citer l'article

Fatih Birol, Africa has the most to gain from clean energy transitions, Jun 2022,