Issue

Issue #1Auteurs

Eric Armando

21x29,7cm - 153 pages Issue #1, September 2021

China’s Ecological Power: Analysis, Critiques, and Perspectives

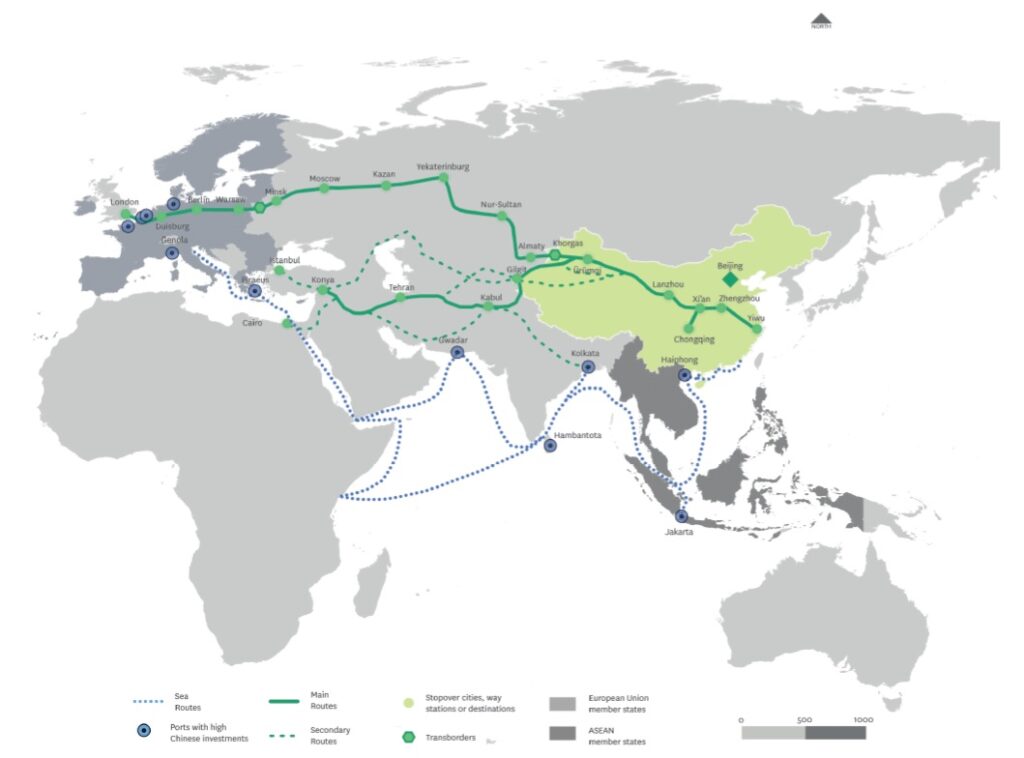

The origins and structuring of the New Silk Roads

When he came to power in 2013, the new Chinese President, Xi Jinping, wanted to benefit from the “pivot towards Asia” policy launched by Barack Obama and take advantage of the economic slump which the West had been in since the 2008 crisis. Incorporating some of the ideas of the academic Wang Jisi (“westward momentum” strategy 西进 1 ) and the strategies of the Ministry of Foreign Affairs, the Chinese President developed a three-fold plan: to strengthen ties between Beijing and its immediate neighbors in order to bring peace to the borders and push American influence out of Asia; to provide outlets for Chinese businesses that had become oversupplied due to the economic slowdown (the domestic market could no longer absorb all of China’s production); and to secure the many strategic routes to and from China while rebalancing the country’s development. The New Silk Roads initiative was born.

The plan was officially announced in September 2013 during a speech delivered in Noursoultan (formerly Astana, Kazakhstan). Invoking the spirit of the ancient caravans which once crossed Central Asia by camel, President Xi proposed a strategic partnership between China, Kazakhstan, Kyrgyzstan, and Uzbekistan, consisting of major investments in roads, railways, gas, oil, and electricity. Barely a month later, President Xi gave the initiative’s second major speech at the Indonesian House of Representatives in which he proposed strengthening the partnership between China and ASEAN 2 and spoke of building a “Maritime Silk Road for the 21st Century”. But it was not until March 2015 that the National Development and Reform Commission published materials on the initiative, particularly emphasizing the “win-win” policy promoted by the initiative, which now has an official name: One Belt, One Road (一带一路). In other words, it refers to a land belt (Astana speech) and a sea route (Jakarta speech). This name was quickly abandoned and replaced by Belt and Road Initiative (BRI) because the first formulation could suggest that there would be only one road, whereas the project envisions an entire network.

The goal of the New Silk Roads, which is still misunderstood but which is nevertheless fundamental, is to breathe new life into China’s western provinces, which have largely been left out of the country’s development and which are experiencing a growing number of difficulties 3 . Xinjiang, for example, is set to become a major energy hub and corridor, serving as a gateway for hydrocarbons from Central Asia. Situated 3,000 km from Beijing, Xinjiang covers an area of 1.6 million km² and is made up of vast desert basins bordered by high mountains. Historically, this region was not part of the Han sphere of influence (its inhabitants are Turkish-speaking Uighurs) and was only integrated into China in 1769, from where it gets its name of Xinjiang, which means “New Frontier. Beijing has been trying to open up and introduce the region into global flows, first through the “Western Development Strategy” (西部大开发) and more recently with the New Silk Roads. If we focus only on the energy aspect, Xinjiang can even be considered as the cornerstone of the BRI. This explains why the Communist government is so anxious about the Uyghurs seeking greater autonomy and its brutal response to ensure the stability of the region in the medium term through forced sinicization, sterilization, and the establishment of a concentration camp system.

Faced with such a sprawling initiative, financing is met through several entities 4 :

- The sovereign wealth fund Silk Road Fund (丝路基金), originally endowed with $40 billion in 2015 to which $10 billion was added in 2017;

- Loans from Chinese strategic banks: China Development Bank ($32 billion), the Export-Import Bank of China ($30 billion), the Agricultural Development Bank of China;

- The Asian Infrastructure Investment Bank (AIIB), endowed with around $100 billion, which was created as a multilateral development bank to complement the World Bank but controlled by China;

- The New Development Bank with about $100 billion in capital which finances infrastructure projects in developing countries;

- Loans from the National Bank of China ($62 billion).

This financing is meant to provide the necessary resources to create or revitalize roads throughout the world.

The initiative’s geography and influence

The New Silk Roads is a vast network which stretches across Eurasia with branches in Africa, America, and even the Arctic. Because China regularly changes the routes that are part of the project, adding and removing them according to its political agenda, it is difficult to accurately list them. Recently, we have even seen countries leave the project, such as Australia did on 21 April 2021, at a time when relations between Beijing and Canberra are at an all-time low. The island-continent is seeking to rid itself of Chinese influence that has been deemed to be problematic due to the corruption of parliamentarians and concerns of espionage 5 . Nevertheless, we can highlight some of the main routes which are of crucial importance to Beijing. The Xi’an – Duisburg route partially following the path of the ancient roads and passes through Urumqi, Horgos, Almaty, Bishkek, Samarkand, Buchanbe, Tehran, and Istanbul, carrying raw materials and energy to China as well as manufactured products destined for Europe. There are many branches throughout Central Asia (the real heart of the Chinese project, both to secure its energy supply and to increase its influence and disseminate its model), in Russia (including the secondary Beijing-Europe route which passes through Ulannnbaatar, Irkutsk, and Moscow), in Pakistan (the highly strategic corridor between Gwadar and Xinjiang), as well as in South Asian countries sympathetic to China (Bangladesh, Myanmar, Laos, Cambodia, etc.) In terms of maritime routes, the Venice-Shanghai corridor is the cornerstone of the initiative and includes Athens, Djibouti, Gwadar, Hambantota. This route has a branch at Gwadar for the Persian Gulf and its considerable energy resources. Other secondary routes lead to Chittagong (Bangladesh), Kyaoukpyu (Myanmar), and even to Nairobi (Kenya) and Caracas (Venezuela). More surprisingly, in order to no longer be dependent on the narrow Malacca Strait, China is planning to create a new route (canal) through the Kra Peninsula (Thailand).

Within China’s borders, all these land routes lead, as we have briefly mentioned, to the Xinjiang Autonomous Region. Sharing its borders with eight countries — Afghanistan, Kazakhstan, Kyrgyzstan, India, Mongolia, Pakistan, Russia, and Tajikistan — the region’s geographic location makes it the ideal gateway for Chinese influence in Central Asia. Since the 1990s, China has built multiple border crossings to promote trade, particularly at the Alataw Pass (or Dzungarian Gate); on the Kazakhstan border, the city of Alashankou became the largest dry port in China for the movement of international freight in 2010, thanks to the linking of the Chinese and Kazakh rail networks. The “dual cities” of Xinjiang are an essential link in China’s strategy to encourage trade — Horgos (China)/Khorgos (Kazakhstan), a major road transit point, is one example.

The goal of these new corridors is clear: to redefine the world order through the BRI, which involves the creation of a kind of “strand of pearls” 6 across the globe, consisting of a series of home ports (maritime or dry) in order to secure supplies for China and to allow the Chinese navy, the People’s Liberation Army, or Chinese companies and businessmen to benefit from “ forward bases “ along the main trade routes. In order to not alarm its partners, the Chinese government delegates the construction of this string of infrastructure projects to large, state-owned companies (the Chinese state itself does not appear) such as the China Communications Construction Company (CCCC), which have immense resources.

Between 2013 and 2015, around sixty countries were involved in the New Silk Roads initiative; in 2020, there were nearly 130. China’s ambition is to bring as many countries as possible into its initiative, but there are several which are key links in this chain. Let us look at three. Pakistan has received special attention from the People’s Republic, which allocated $46 billion in 2015 to create an economic corridor between the port of Gwadar and Kashgar. This is where the Karakoram road starts, crossing the mountain range of the same name and leading into China (Xinjiang). Gwadar is strategic in more ways than one. As it is surrounded by deep waters, all types of ships can dock there. The presence of a Pakistani military base grants China a certain stability and could eventually allow the People’s Liberation Army to set up an outpost there. Finally, Gwadar’s proximity to the Gulf of Oman makes it an ideal port of entry to bring hydrocarbons from the Middle East into China, especially since China now has a presence in Djibouti. A terminal for gas tankers will allow gas to be imported from Qatar and the liquification of gas from Iran; a refinery combined with an oil pipeline will send the crude to Xinjiang. The New Silk Roads initiative also allows Pakistan to find financing solutions for thermal power stations at a time when western banks are becoming increasingly hesitant to invest in these projects, especially if they include coal. China is much less discriminating, as evidenced by the consortium formed by China Huaneng Group and Shandong Ruyi, which will operate the highly profitable Sahiwal power plant for the next 30 years and which provided 20% of the needed capital ($355 million) with the remaining $1.4 billion loaned to Pakistan by the Industrial and Commercial Bank of China. Finally, Pakistan is India’s nemesis, itself a regional rival of China’s. Maintaining good relations with Islamabad allows Beijing to increase pressure on New Delhi.

After Pakistan, Myanmar is a second Chinese source of energy supply security while also being near India. The opening of a corridor between the port of Sittwe and Kunming (Yunnan) for transporting oil helps to diversify China’s energy routes. Beijing has also established a presence on the Coco Islands, building a communications interception station in 1992 to monitor maritime traffic while being in close proximity to India, whose Andaman Islands are only about 20 km away. A military port project is being studied on Little Coco Island, while on the mainland, the port of Kyaukpyu has been expanded by Chinese capital and privatized. The recent turmoil in Myanmar is being closely monitored by China — a military victory and a return to dictatorship would allow Beijing to regain control of the country by brushing aside the influence of the United States and Japan, which had grown stronger during the democratic period.

Figure 1 • Map of the New silk roads of energy

Due to its great hydrocarbon resources, Kazakhstan accounts for more than 70% of Chinese investments in Central Asia 7 . Kazakhstan’s economy is based mainly on exporting gas and oil, of which it has 3% of the world’s resources, as well as uranium, which accounts for 12% of the world’s resources, with production of 19,500 tons in 2020. Several oil and gas pipelines run through this immense country of 2.7 million km², whose population is only 19 million. These pipelines run from Beyneu on the Caspian Sea to Horgos on the Chinese border (gas pipeline), and from Atyrau in the west of the country to Karagandy in the center and Alashankou near Xinjiang.

An initiative which serves Chinese energy security

Despite its vast size, China is a country with relatively few oil and gas resources, with the exception of a few oil and gas wells in Xinjiang (Dzungary and Taklamakan). It does, however, have abundant coal deposits, the largest of which are located far from urban centers in Xinjiang, Shanxi, and Inner Mongolia. The strong economic growth that has characterized the country for several decades has been accompanied by a sharp increase in energy demand which has been reinforced by prices that have been kept artificially low to encourage consumption. This demand could only be met through a policy of aggressive coal mining, which has made it the primary source of electricity in China for decades. However, domestic production was quickly unable to keep up and since 2009 Beijing has had to import coal on a massive scale (304 million tons by 2020 8 ), exposing the country to the threat of a sudden change in prices or a breakdown in trade relations. In the Middle Kingdom itself, the economic model of mining is running out of steam — “mini-mines” in disadvantaged areas are now used to buy social appeasement, even though their productivity is very low and their ecological impact immense 9 . At the opposite end of the spectrum, state-owned enterprises are generally giant technostructures with low yields (excessive labor, debt ratio that is too high). The massive use of lignite is also having disastrous health consequences. In 2016, only 2% of the Chinese population breathed air that complied with WHO recommendations, largely because of coal usage. Faced with this problem, the Chinese Communist Party (CCP) is aggressively developing alternative energies (renewable and nuclear) but has been unable to significantly reduce the proportion of fossil fuels which represented 78.5% of China’s electrical mix in 2008 and was still at 70.3% in 2018 10 (at the same time, consumption of fossil fuels has seen a three-fold increase, from 11,119 TWh to 33,512 TWh).

The Communist regime’s continued existence, based on the social pact of “stability and wealth for submission and loyalty” — which dates to the era of Deng Xiaoping’s economic reforms (1978-1992) and are a contemporary manifestation of the ancient “Mandate from Heaven” (天命 the belief that the government’s legitimacy comes from its ability to ensure the wealth and security of its people) — depends on maintaining strong growth. In its quest for survival, the Party spares no expense and must generate considerable energy in order to maintain energy-intensive industries (cement plants, steel mills, glass factories, etc.) to produce growth. This explains the proliferation of excessive and often irrational infrastructure projects. In addition, China has a particularly high energy intensity, although it is constantly falling: 0.79 in 1980; 0.23 in 2000; 0.13 in 2019. For comparison, Japan’s energy intensity was 0.08 and India’s was 0.09 in 2019 11 .

Ensuring a constant energy supply for Chinese industries, which are the drivers of growth, is therefore of utmost importance to Beijing. While the pharaonic New Silk Roads initiative is generally presented as a means of providing outlets for China’s overproduction, its geostrategic dimension in the field of energy is of vital importance to China.

It is particularly crucial for China to secure these routes because current ones depend on choke points that could be used as leverage to apply pressure. This is especially true of the tricky passage through the Strait of Malacca 12 , an area plagued by piracy and which gives significant leeway to the city-state of Singapore, which is on good terms with the United States 13 . In the event of a conflict with America, a blockade of Malaysia and the Sunda Strait could totally paralyze China. China therefore has every intention of diversifying the origins of its energy resources and increasing its number of trade corridors.

China has also been wooing oil-producing countries, primarily Iran and Venezuela, with the latter settling its debts to China directly in black gold. The China National Petroleum Corporation (CNPC, 中国石油天然气集团公司) and the China National Offshore Oil Corporation (CNOOC) have numerous interests in this South American country, and the route remains open despite U.S. sanctions. In the Central Asian region, in addition to railroads and highways, it is above all energy imports that play a key role. More than anything, Beijing wants to secure an oil pipeline that runs from Atasu (Kazakhstan) to Alashankou in China. A crucial piece of infrastructure is already in place in Horgos (Xinjiang) – a gas pipeline that links Turkmenistan to Shanghai and allows China to receive 55 billion cubic meters of natural gas from Turkmenistan, Uzbekistan, and Kazakhstan every year. This energy route is therefore spreading to the four corners of Central Asia, and with it the powerful CNPC, which has taken a leading role in oil extraction not only in Kazakhstan (Atyrau, Mangystau, Kyzylorda, Darkhan), but also in Turkmenistan (which allowed China to control a quarter of its gas production in 2015), and Uzbekistan. The resulting energy corridor is 9,000 km long, running from the Caspian Sea to the Chinese coast. But beyond fossil resources, China has been increasingly focused on the atom and Beijing has now cornered a part of Kazakhstan’s rich uranium deposits. In 2014, China General Nuclear (CGN) signed agreements with KazAtomProm to extract and enrich uranium in Kazakhstan and more than half of the Kazakh national company’s production has subsequently been exported to China. In December 2015, the two countries announced the creation of a $2 billion fund to carry out bilateral projects as part of the New Silk Roads, including the Ulba-FA nuclear fuel production plant (a joint venture between KazAtomProm and CGN), whose construction began in 2016 and was completed in 2020.

The place of renewable and alternative energies

Alternative energies such as nuclear and renewables have a place in China’s BRI strategy, but in a different form than fossil resources. First and foremost, China needed the missing renewable and nuclear technologies. A great scientific power for many centuries, China has experienced a long period of stagnation in the modern era 14 . Reforms made starting in the 1970s were not only aimed at increasing China’s economic power but also at obtaining official technologies so that the Middle Kingdom could catch up and eventually regain its leadership status. The requirement that foreign companies wishing to set up operations in China must establish a joint venture with a Chinese partner is one of the measures imposed in many sectors that has led to a massive strengthening of China’s role in the innovation market. President Hu Jintao (with his Prime Minister Wen Jiabao) was the first to pursue a national innovation policy (自主创新) which was then taken up by Xi Jinping’s government with the Made in China 2025 plan (中国制造2025). A “Nuclear Silk Road” was set up as early as the 1980s to provide the country with reactors: AECL (Canada), Atomstroyexport (Russia), Framatome (France), and Westinghouse (United States) were all involved, enabling the country to have a large fleet of 49 reactors (47.8 GWe 15 ) by January 2020, with another 16 under construction. Following the success of this strategy, in the early 2010s, the People’s Republic launched an ambitious domestic program that culminated in the January 30, 2021 launch of Hualong-1, a third-generation pressurized water reactor. In order to close the nuclear fuel circle, China hopes to build a reprocessing plant on its soil, again through technology transfer; discussions with France are underway. With its expertise in nuclear technology, China has begun exporting the Hualong-1 reactor along the Silk Roads with two under construction in Pakistan and negotiations underway with Romania, Iran, Turkey, and Kenya.

For decades now, health concerns have largely been overlooked in China. However, the current energy-intensive model, supported by highly subsidized electricity to promote growth, seems to have reached its limits. On the one hand, this is due to changing public opinion, which is tired of living in perpetual smog, and on the other hand, it is difficult to sustain the upward evolution of China’s industry and its innovation. This is especially true of the “export” aspect of the BRI, which is directed at Europe at the far end of the New Silk Road. Since signing the Paris Agreement in June 2017, and even more so after the American withdrawal, China has considered itself to be an environmental champion. In addition to increasing China’s market share in a booming industry with very high added value, this stance is designed to force the West to make a choice between respecting human rights and reducing Chinese greenhouse gas emissions. The idea of encouraging a “green” BRI is gaining ground (Belt and Road Ecological and Environmental Plan, 2017), allowing China to promote its low-carbon technologies for export in the medium term.

And yet, China has a powerful asset that could lead it to becoming the leading export power of low-carbon technologies along the New Silk Roads: its giant rare earth minerals industry (90% of global production in 2016) and the capability to process them domestically (75% of global demand) 16 . The turning point for China came in 1995, when the American permanent magnet producer Magnequench was bought out by the investment fund Sextant, itself owned by San Huan New Material and the China National Non-Ferrous Metals Import and Export Corporation, headed by two of Deng Xiaoping’s sons-in-law. The technology for manufacturing fine granules of magnets from rare earth minerals, which are essential for the production of wind turbines and electric vehicles, was thus repatriated to China along with all the assets of Magnequench. With the Renewable Energy Promotion Law of 2003 and the Renewable Energy Law of 2005, Beijing has sought to create a favorable domestic environment for renewable energy research, with a threefold objective: to reduce dependence on energy imports, to develop domestic renewable energy industries, and, above all, to launch an overseas-oriented trade policy. The state-owned Xiangtan Electric Manufacturing Corporation (XEMC), financially supported by Beijing and benefiting from comparative advantages beyond the reach of its competitors with preferential access to rare minerals and low labor costs, has been increasing its joint ventures since 2012 in Finland, Japan, the Netherlands, and Germany. In general, Chinese clean-tech companies receive considerable support; in 2015, they attracted $34.6 billion in private funding, twice as much as in the United States 17 . China has succeeded in creating international leaders in the high-value-added environmental sector, in wind power, batteries, and photovoltaics. Now that the market is developed, the Silk Roads are destined to become conduits for “green” energy flows from China to the rest of the world. Among the energy projects currently under development, Pakistan claims the lion’s share: more than a dozen projects are underway, including renewable power plants such as the HydroChina Dawood Wind Power Project east of Karachi, at a cost of $115 million, funded by the Industrial and Commercial Bank of China.

The initiative’s political difficulties

Despite its obvious strengths and the unwavering support of the Beijing government, the New Silk Roads project has many weaknesses that have the potential to undermine the entire Chinese strategy. The first, and no doubt most dangerous, is China itself, or rather its diplomatic personnel and the version of the country portrayed on the international stage. Since Xi Jinping came to power, China’s traditional diplomatic restraint has taken a completely different direction, known as “wolf warrior diplomacy”. In order to be seen as valuable by the central power, Chinese diplomats compete to demonstrate their nationalism in the hope of promotion and no longer hesitate to attack, in an extremely aggressive manner, any figure or institution that would criticize the People’s Republic. Although this is a domestic political strategy designed to pander to the unbridled nationalism of the Chinese population, the consequences abroad are very damaging for Beijing. As a poll conducted by Pew Research in 14 countries shows, 74% of respondents have a negative view of the People’s Republic of China 18 , and Western public opinion overwhelmingly rejects China. Moreover, the consequences of this diplomacy can also be seen in China itself. For instance, Australia, which has publicly requested an impartial investigation into the origins of the Sars-cov-2 virus, has suffered the wrath of the wolf warriors. China retaliated by stopping the import of Australian coal, causing power cuts in winter when production could not meet demand. As a result, China was forced to increase imports from Pakistan. However, Islamabad did not have the capacity to meet Chinese demands, so the country imported coal above market price… from Australia! China itself was responsible for the disruption of its supply 19 . But beyond this example, growing distrust of China in the Western world could undermine the very purpose of the Silk Roads for Energy, which is built in part, as we have seen, on the export of environmental technologies to Europe.

Losing sovereignty to China over parts of their territory is also a concern for emerging economies participating in the BRI. The Hambantota port in Sri Lanka is an excellent example of this. A critical maritime asset along the Pakistan-China route, it cost about $350 million to build, funded almost exclusively by the Export-Import Bank of China. But its disproportionate size and inability to compete with the already thriving port of Colombo forced Sri Lanka to open debt restructuring negotiations with China, as profits were insufficient. Beijing wiped the slate clean in exchange for an exclusive concession of the port’s 60 square kilometres of land for a 99-year lease, starting in July 2017. In Mombasa, Kenya’s main port, the signing of an $82 million contract with the China Road and Bridge Corporation in 2011 to expand the capacity of its docks has raised fears that the African country, which is already heavily in debt, will not be able to repay its commitments and will have to give up part of the port’s resources and the highly strategic railway line between the maritime facilities and the capital Nairobi. As early as 2018, the International Monetary Fund warned against Chinese loans, as their interest rates of up to 7% are often unsustainable 20 . Malaysian Prime Minister Mohamad Mahathir, seeing the Chinese trap, secured a cost reduction of about 33% for a railroad and pipeline in his country, the East Coast Rail Link, from 65.5 billion ringgit to 44 billion ringgit ($10.7 billion) after initially withdrawing from the project that his predecessor Najib Razak (2009-2018) had signed.

Europeans are divided on this issue. Both Greece, with Piraeus, and Italy, with the ports of Genoa and Trieste, are dependent on Chinese investment and have joined the BRI. Northern Europe, and Germany in particular, is wary of criticizing Beijing because of the dependence of its economies on exports to China. Cautious France was forced to break its silence after multiple orchestrated provocations by the Chinese Embassy in Paris 21 .

Finally, we must take into account what could be called the “sublime isolation of China”. The Middle Kingdom dreams of being a hyperpower but has no powerful ally to build the New Silk Roads project with it. The country’s relations with Russia are quite erratic; while both countries want to overthrow the international order they inherited from the Second World War and share a certain ideological similarity, they are also rivals in a large number of areas. This is especially true when it comes to their hold over Central Asia which is critical for China’s energy survival, but has traditionally been beholden to Moscow. In 2015, Russia had launched its own project, the Eurasian Economic Union (EEU), comprising Russia, Belarus, Kazakhstan, Armenia, and Kyrgyzstan, before Vladimir Putin announced that this union would join the New Silk Roads. Behind its seeming adherence to the BRI project, Russia is acting underhandedly to maintain its influence, for example by proposing to China that Moscow be the guardian of the security and stability of Central Asia. It should also be noted that relatively few countries share a real ideological affinity with China — Vietnam cut some of its ties with its powerful neighbor after its invasion of Democratic Kampuchea in 1978-79 and the subsequent China-Vietnam war (1979). It is worth mentioning that Vietnam is not interested in the BRI and does not wish to seek Chinese loans. North Korea, on the other hand, is seen as an unpredictable but indispensable protectorate to secure the northeastern border of the People’s Republic. If its coal mines are used to feed the Chinese energy program, the extreme weakness of its production and its infrastructure make it only a last rank trade partner — China represents 83% of North Korean exports but only $2.8 billion. For the record, North Korea’s GDP is estimated at $29 billion, which represents 1.5% of its southern neighbor’s GDP. Lastly, Venezuela is engulfed in a severe economic crisis and seems to be surviving only with China’s help, who is taking advantage of the situation to demand nearly 500,000 barrels of oil per day (about 5% of Chinese imports of black gold in 2017) 22 . Other states having affinities with China are above all driven by strictly economic, national, or personal interests. The recent shifts in the alliances of the Solomon Islands and Kiribati, which broke off diplomatic relations with the Republic of China (Taiwan) to recognize the People’s Republic, were motivated by Beijing’s largesse and have little to do with China’s development model. While China may be getting stronger, it is not managing to generate support and its soft power remains very weak. Despite all of President Xi’s efforts, the “Chinese dream” is having trouble scaling the Great Wall.

Once more in this initiative, China is its own worst enemy. The heaviness of the Communist Party and its bureaucratic organization of “cliques” fighting each other impedes rational decision making 23 . The hunt for political enemies, under the hypocritical pretext of fighting corruption, leads to instability in key ministries. Above all, appointments are now made based on loyalty to Xi rather than on qualifications.

Companies — which are officially private but are in reality supported by the state — that invest along these energy routes are anxious to receive public subsidies. They are eager to throw themselves into various projects in order to be well-regarded in Beijing, even if it means defying rules of good management. The New Silk Roads, and especially their energy component, require a great deal of capital. Building ports, oil pipelines, or refineries takes a great deal of financing. The necessary investments are estimated to be between $4,000 billion and $26,000 billion 24 , which is twice China’s GDP at its highest estimate. Beijing’s attempts at attracting foreign investors are mostly met with polite refusal as enormous infrastructure projects are not highly profitable, the countries targeted are often unstable, and China is cloaked in proverbial secrecy. Western, as well as Asian, elites are in no rush to invest. A first slowdown in BRI financing can already be seen in calculations by RWR Advisory 25 , which showed that from $150 billion in annual lending in 2014-2015, the figure had dropped below $100 billion in 2017 and 2018.

The initiative’s lack of clarity is also a major hurdle for potential partners. Since 2013, the BRI has changed its focus several times with new routes being added or removed depending on the political, economic, or social landscape and the moment’s ideological needs. The control of information and, more seriously, its changeability, led countries such as Germany and France to refuse signing the final statement of the Belt and Road forum in 2017 due to its critical lack of specifics.

Japan, a traditional ally of the United States who maintains good relations with India but whose relationship with China is not always easy, has expressed its opposition to the New Silk Roads. In 2015, Tokyo unveiled its Indo-pacific strategy in partnership with the Asian Development Bank based on liberal values which it calls “Partnership for Quality Infrastructure” (PQI) which is endowed with $110 billion. As with the BRI, the heart of the project is its energy component. Tokyo hopes that Japanese companies, through public-private partnerships in Asian and African countries, will increase their electrical production capacity to 2,000 MW by 2023, mainly in geothermal energy. The PQI rests on five principles: effective leadership, economic efficiency, job creation, strengthening capacity for the transfer of expertise and skills, and managing the social and environmental impacts of these infrastructure projects. By 2019, the project’s funds had nearly doubled to $200 billion 26 . Japan highlights the high quality of its technological expertise and infrastructure to set itself apart from a still unappealing “Made in China”. It is implicitly criticizing an imperialist and aggressive China whereas it values cooperation and the respect of liberal values. And so, in 2017, Prime Ministers Abe (Japan) and Modi (India) inaugurated the first high speed rail line in India which was 80% financed by Japan. These two Asian giants also teamed up in the “Asia-Africa Growth Corridor” (AAGC) which explicitly aims to act as a foil to the Chinese New Silk Roads and is supported by the United States. As with the Chinese example, securing energy supplies is critical, especially since Japan has drastically reduced the share of nuclear energy in its energy mix since 2011 and that, unlike its large neighbor, the island nation has no energy resources. India and Japan therefore aim to secure the Indo-pacific coastline by first connecting the ports of Djibouti and Jamnagar (Gujarat), and from Mombasa and Zanzibar to Madura (Tamil Nadu). But the AAGC is still in its infancy and it is still hard to know if the project will truly be able to compete with and offer a liberal alternative to China’s New Silk Roads.

In conclusion, the New Silk Roads of Energy initiative is critical to China’s strategy of independence and growth. Beijing hopes to diversify its supply sources all while increasing its regional and global influence, including breaking the liberal model put in place following World War 2. China has many means for bringing this project to fruition , but there are very real challenges that must not be overlooked: costly financing, concerned partners, political blunders, and the implementation of opposing projects all greatly damage the New Silk Roads’ rebirth.

Notes

- J. Wang, “Westward, China’s Own Geostrategic Rebalancing”, Global Times, October 2012.

- Association of Southeast Asian Nations with ten countries: Malaysia, Singapore, Thailand, the Philippines, Brunei, Vietnam, Laos, Myanmar, and Cambodia.

- E. De la Maisonneuve, “Une ceinture, une route ; ou le versant chinois de la mondialisation”, Revue Défense Nationale, 2018.

- C. Vicenty, “Les Nouvelles routes de la soie : ambitions chinoises et réalités géopolitiques”, Géoéconomie, 2016.

- E. Véron, E. Lincot, “L’Australie face à la Chine : la montée des tensions”, The conversation, March 2021.

- K. Merigot Kevin, “‘Collier de perles’ et bases à usage logistique dual”, Geostrategia, February 2019.

- A. Cariou Alain, “Les corridors centrasiatiques des Nouvelles routes de la soie : un nouveau destin continental pour la Chine”, L’Espace géographique, 2018.

- X. Muyu, S. Shivani, “China’s coal consumption seen rising in 2021, imports steady”, Reuters, March 2021.

- G. Michel, “Chine : l’énergie, un enjeu stratégique”, Politique étrangère, 2018.

- “China’s energy market in 2018”, BP Statistical Review – 2019.

- IEA Atlas of Energy, IEA website, energy intensity in 2015 US dollars.

- E. Puig, “Belt and Road Initiative, ou les habits neufs de la stratégie chinoise”, Revue Défense nationale, 2018.

- Links strengthened by the Free Trade Agreement between the two countries and the annual Strategic Partnership Dialogue.

- This is the “Needham question”, from the famous English sinologist of the same name, who tried to understand why China had not experienced the industrial revolution and lost its global technological leadership.

- For comparison, in France: 63,2 GWe.

- E. Lanckriet, J. Ruet “ La longue marche des nouvelles technologies dites ‘environnementales’ de la Chine : capitalisme d’État, avantage comparatifs construits et émergence d’une industrie ”, Annales des Mines – Gérer et comprendre, 2019.

- Ibid.

- L. Silver, K. Delvin, C. Huang, “Unfavorable Views of China Reach Historic Highs in Many Countries”, Pew Resseach Center, October 2020.

- “Les conséquences de l’embargo chinois sur le charbon australien”, Transitions et Energies, December 2020.

- Ms. Lagarde’s speech in Beijing at the New Silk Roads” forum in April 2018. See also Maureau Florine, “Le piège de la dette chinois se referme sur les intérêts français”, Intelligence Economique, March 25th 2021

- Among others, pressure on exhibitions in France (Kerviel Sylvie, “Une exposition sur Gengis Khan au Musée d’histoire de Nantes censurée par la Chine”, Le Monde, October 13th 2020) or insults to a French researcher (Seibt Sébastian, “Quand l’ambassade de Chine se déchaîne contre un chercheur français”, France 24, March 22th 2021).

- M. Albert, C. Jude , “Venezuela : l’insoutenabilité du modèle de croissance, source de tous les risques”, Revue d’économie financière, 2016, (data updated by the author).

- A time-honored formula for distinguishing CCP factions, see for example A. Payette, “Chine : Xi Jinping ‘président à vie’ ? Peut-être, mais il devra négocier”, Asialyst, April 2021 ; M. Finkelstein, M. Kivlehan, “China’s leadership in the twenty-first century : the rise of the fourth generation”, Routledge, 2002.

- E. Mottet, F. Lasserre, “La Belt and Road Initiative, un projet viable ?”, Revue internationale et stratégique, 2019.

- The Belt and Road Monitor (website), RWR Advisory Group.

- J. Babin, “La Stratégie Indo-Pacifique libre et ouverte, un contre-projet japonais aux Nouvelles routes de la soie ?”, Groupe d’études et de recherche sur l’Asie contemporaine, September 2019.

citer l'article

Eric Armando, Understanding the New Silk Roads of Energy, Sep 2021, 90-97.

à lire dans cette issue

voir toute la revue